Final Return For Earned Income Tax - West Shore Tax Bureau Form 2002

ADVERTISEMENT

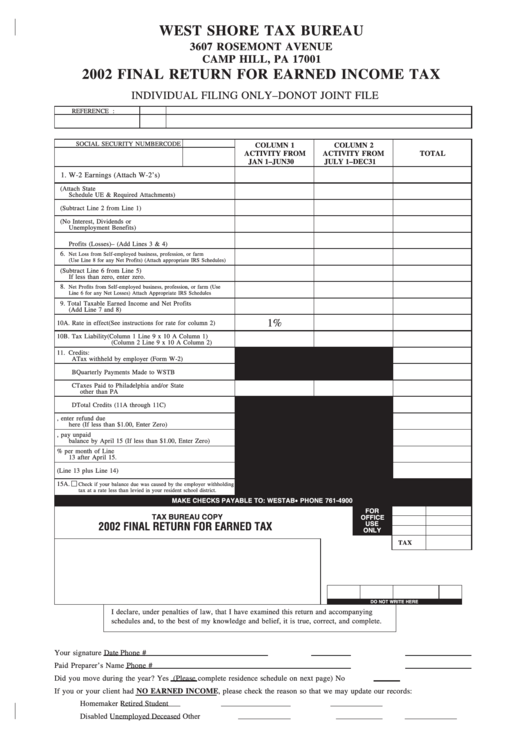

WEST SHORE TAX BUREAU

3607 ROSEMONT AVENUE

CAMP HILL, PA 17001

2002 FINAL RETURN FOR EARNED INCOME TAX

INDIVIDUAL FILING ONLY – DO NOT JOINT FILE

REFERENCE NO.

PSD

OUR RECORDS INDICATE YOU ARE A RESIDENT OF:

SOCIAL SECURITY NUMBER

CODE

COLUMN 1

COLUMN 2

ACTIVITY FROM

ACTIVITY FROM

TOTAL

JAN 1 – JUN 30

JULY 1 – DEC 31

11. W-2 Earnings (Attach W-2’s)

12. Employee Business Expenses (Attach State

Schedule UE & Required Attachments)

13. Taxable W-2 Earnings (Subtract Line 2 from Line 1)

14. Other Taxable Earned Income (No Interest, Dividends or

Unemployment Benefits)

15. Total Taxable Earned Income Before Net

Profits (Losses) – (Add Lines 3 & 4)

16.

Net Loss from Self-employed business, profession, or farm

(Use Line 8 for any Net Profits) (Attach appropriate IRS Schedules)

17. Subtotal (Subtract Line 6 from Line 5)

If less than zero, enter zero.

18.

Net Profits from Self-employed business, profession, or farm (Use

Line 6 for any Net Losses) Attach Appropriate IRS Schedules

19. Total Taxable Earned Income and Net Profits

(Add Line 7 and 8)

1%

10A. Rate in effect (See instructions for rate for column 2)

10B. Tax Liability (Column 1 Line 9 x 10 A Column 1)

(Column 2 Line 9 x 10 A Column 2)

11. Credits:

A Tax withheld by employer (Form W-2)

B Quarterly Payments Made to WSTB

C Taxes Paid to Philadelphia and/or State

other than PA

D Total Credits (11A through 11C)

12. If Line 11D is larger than Line 10, enter refund due

here (If less than $1.00, Enter Zero)

13. If Line 10 is larger than Line 11D, pay unpaid

balance by April 15 (If less than $1.00, Enter Zero)

14. Add Interest and Penalty of 1% per month of Line

13 after April 15.

15. Pay Balance Due with the return (Line 13 plus Line 14)

15A.

Check if your balance due was caused by the employer withholding

tax at a rate less than levied in your resident school district.

MAKE CHECKS PAYABLE TO: WESTAB • PHONE 761-4900

FOR

TAX BUREAU COPY

OFFICE

USE

2002 FINAL RETURN FOR EARNED TAX

ONLY

TAX

DO NOT WRITE HERE

I declare, under penalties of law, that I have examined this return and accompanying

schedules and, to the best of my knowledge and belief, it is true, correct, and complete.

Your signature

Date

Phone #

Paid Preparer’s Name

Phone #

Did you move during the year? Yes

(Please complete residence schedule on next page) No

If you or your client had NO EARNED INCOME, please check the reason so that we may update our records:

Homemaker

Retired

Student

Disabled

Unemployed

Deceased

Other

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2