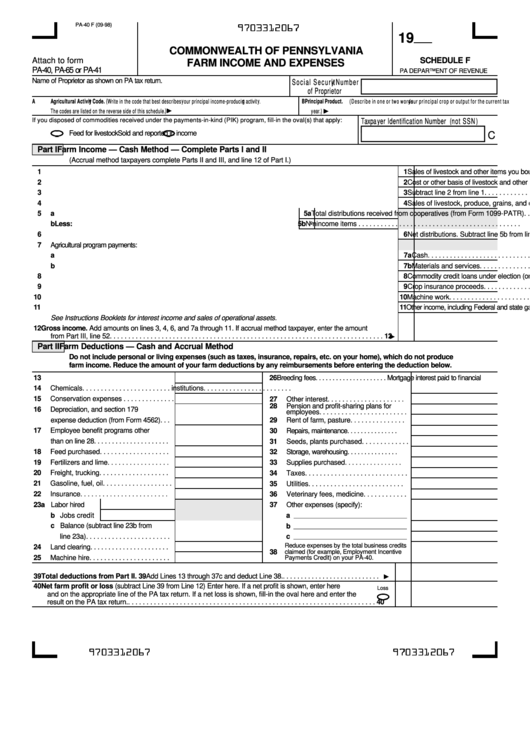

Form Pa-40 F - Schedule F - Farm Income And Expenses

ADVERTISEMENT

kibeecdbhi

PA-40 F (09-98)

19

COMMONWEALTH OF PENNSYLVANIA

SCHEDULE F

Attach to form

FARM INCOME AND EXPENSES

PA-40, PA-65 or PA-41

PA DEPARTMENT OF REVENUE

Name of Proprietor as shown on PA tax return.

Social Security Num ber

of P roprietor

A

Agricultural Activity Code. (W rite in the code that best describes your principal income-pro ducing activity.

B Principal Product. (Describe in one or two words your principal crop or output for the current tax

^

^

The codes are listed on the reverse side of this schedule.)

year.)

If you disposed of commodities received under the payments-in-kind (PIK) program, fill-in the oval(s) that apply:

Taxpayer Identification Num ber (not SSN)

Feed for livestock

Sold and reported in income

C

Part I

Farm Income — Cash Method — Complete Parts I and II

(Accrual method taxpayers complete Parts II and III, and line 12 of Part I.)

1

Sales of livestock and other items you bought for resale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

Cost or other basis of livestock and other items you bought for resale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3

Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Sales of livestock, produce, grains, and other products you raised . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

a

Total distributions received from cooperatives (from Form 1099-PATR) . . . . . . .

5a

b Less:

Nonincome items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5b

6

Net distributions. Subtract line 5b from line 5a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7

Agricultural program payments:

a

Cash. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7a

b

Materials and services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7b

8

Commodity credit loans under election (or forfeited) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9

Crop insurance proceeds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10

Machine work . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11

Other income, including Federal and state gasoline tax credit or refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

See Instructions Booklets for interest income and sales of operational assets.

12

Gross income. Add amounts on lines 3, 4, 6, and 7a through 11. If accrual method taxpayer, enter the amount

^

from Part III, line 52 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

Part II

Farm Deductions — Cash and Accrual Method

Do not include personal or living expenses (such as taxes, insurance, repairs, etc. on your home), which do not produce

farm income. Reduce the amount of your farm deductions by any reimbursements before entering the deduction below.

13

Breeding fees . . . . . . . . . . . . . . . . . . . . .

26

Mortgage interest paid to financial

14

Chemicals . . . . . . . . . . . . . . . . . . . . . . . .

institutions . . . . . . . . . . . . . . . . . . . . . . . .

15

Conservation expenses . . . . . . . . . . . . . .

27

Other interest . . . . . . . . . . . . . . . . . . . . .

28

Pension and profit-sharing plans for

16

Depreciation, and section 179

employees . . . . . . . . . . . . . . . . . . . . . . . .

expense deduction (from Form 4562) . . .

29

Rent of farm, pasture . . . . . . . . . . . . . . .

17

Employee benefit programs other

30

Repairs, maintenance . . . . . . . . . . . . . . .

than on line 28 . . . . . . . . . . . . . . . . . . . . .

31

Seeds, plants purchased . . . . . . . . . . . . .

18

Feed purchased . . . . . . . . . . . . . . . . . . .

32

Storage, warehousing . . . . . . . . . . . . . . .

19

Fertilizers and lime . . . . . . . . . . . . . . . . .

33

Supplies purchased . . . . . . . . . . . . . . . .

20

Freight, trucking . . . . . . . . . . . . . . . . . . .

34

Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

Gasoline, fuel, oil . . . . . . . . . . . . . . . . . . .

35

Utilities . . . . . . . . . . . . . . . . . . . . . . . . . .

22

Insurance . . . . . . . . . . . . . . . . . . . . . . . .

36

Veterinary fees, medicine . . . . . . . . . . . .

23

a Labor hired

37

Other expenses (specify):

b Jobs credit

a

________________________________________

c Balance (subtract line 23b from

b

________________________________________

line 23a) . . . . . . . . . . . . . . . . . . . . . . .

c

________________________________________

Reduce expenses by the total business credits

24

Land clearing . . . . . . . . . . . . . . . . . . . . . .

claimed (for example, Employment Incentive

38

25

Machine hire . . . . . . . . . . . . . . . . . . . . . .

Payments Credit) on your PA-40.

^

39 Total deductions from Part II.

Add Lines 13 through 37c and deduct Line 38. . . . . . . . . . . . . . . . . . . . . . . . . . . .

39

40 Net farm profit or loss (subtract Line 39 from Line 12) Enter here. If a net profit is shown, enter here

Loss

and on the appropriate line of the PA tax return. If a net loss is shown, fill-in the oval here and enter the

result on the PA tax return. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

40

kibeecdbhi

kibeecdbhi

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2