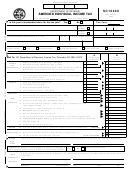

Form Sc1040x - Amended Individual Income Tax Page 2

ADVERTISEMENT

INSTRUCTIONS FOR FILING AMENDED RETURNS

1. Form SC1040X should be used when filing an amended individual income tax return. Enter the tax year in the upper

right hand corner of Form SC1040X. Furnish all information requested. SC1040X can be filed only after you have filed

an original return.

Mail to: SC Department of Revenue

Income Tax

Columbia, SC 29214-0012

2. Any changes made to the original return should be explained in Part II. A change in tax withheld must be verified by a

wage and tax statement. Tax credits for tax paid to other states must be verified by a copy of the other state's income

tax return and federal return. Other credits must be supported by a properly completed South Carolina form.

3. The Statute of Limitations for filing claims for refund is three years from the time the timely filed return, including

extensions, was filed, or two years from the date of payment, whichever is later.

4. When items are in question, refer to instructions for preparing form SC1040A, SC1040, SC1040NR, or Schedule TC,

whichever is applicable.

(

1) As Originally

(2) Net

(3) Correct

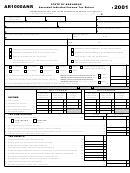

PART I - NONRESIDENT

Reported

Change

Amount

25.

Adjusted S.C. Gross Income from back of Form SC1040NR, line 55, col. B . . . .

25

.

26.

Corrected Proration (line 25, col. 3

corrected federal adjusted gross income)

%

.

26

27.

TOTAL Itemized (standard) Deductions and Exemptions . . . . . . . . . . . . . . . .

27

28.

Allowable Itemized (standard) Deductions and Exemptions (multiply line 27, col.

3 by corrected percent.)

28

29.

Total SC deductions from back of Form SC1040NR, line 62, col. B

29

30.

Add line 28 and 29, col. 3 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

31.

Modified South Carolina taxable income as corrected (line 25, col. 3 less line 30, col. 3)

Enter results from column 3 to line 3 column C on front of SC1040X . . . . . . . . .

Compute tax and enter on line 4 column C on front of SC1040X.

31

PART II - Explanation of changes to income, payments and credits. Enter the line reference from page 1 or PART I for

which you are reporting a change and give the reason for each change. Attach applicable schedules.

Failure to provide an explanation or supporting documentation will result in a delay in processing your

return.

z

Have you been advised that your orginal state return is being or will be audited by the SC Department of

Revenue?

Yes

No

z

Are you filing this amended return due to a Federal adjustment? If yes, attach a copy of the Federal Audit or

adjustment.

Yes

No

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2