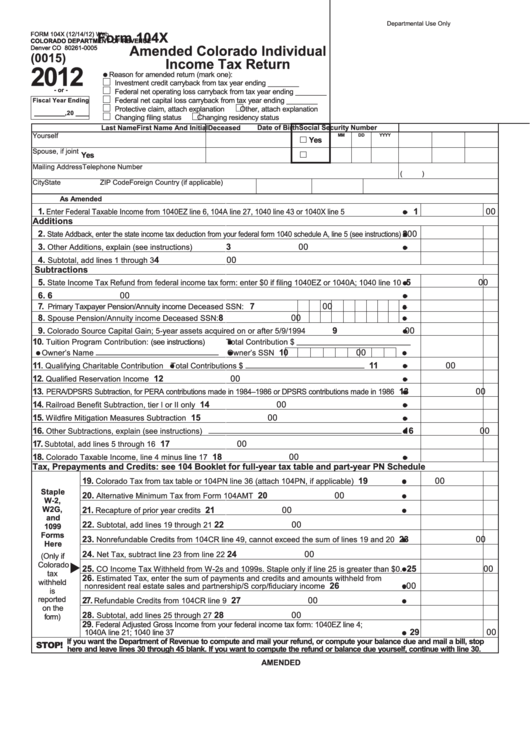

Form 104x - Amended Colorado Individual Income Tax Return - 2012

ADVERTISEMENT

Departmental Use Only

Form 104X

FORM 104X (12/14/12)

FORM 104X (12/14/12) Web

COLORADO DEPARTMENT OF REVENUE

COLORADO DEPARTMENT OF REVENUE

Amended Colorado Individual

Denver CO 80261-0005

Denver CO 80261-0005

(0015)

Income Tax Return

2012

Reason for amended return (mark one):

Investment credit carryback from tax year ending ________

- or -

Federal net operating loss carryback from tax year ending ________

Federal net capital loss carryback from tax year ending ________

Fiscal Year Ending

Protective claim, attach explanation

Other, attach explanation

_________ ,20 ____

Changing filing status

Changing residency status

Last Name

First Name And Initial

Date of Birth

Social Security Number

Deceased

Yourself

MM

DD

YYYY

Yes

Spouse, if joint

Yes

Mailing Address

Telephone Number

(

)

City

State

ZIP Code

Foreign Country (if applicable)

As Amended

1.

1

00

Enter Federal Taxable Income from 1040EZ line 6, 104A line 27, 1040 line 43 or 1040X line 5

Additions

2.

2

00

State Addback, enter the state income tax deduction from your federal form 1040 schedule A, line 5 (see instructions)

3.

3

00

Other Additions, explain (see instructions)

4.

4

00

Subtotal, add lines 1 through 3

Subtractions

5.

5

00

State Income Tax Refund from federal income tax form: enter $0 if filing 1040EZ or 1040A; 1040 line 10

6.

6

00

U.S. Government Interest

7.

7

00

Primary Taxpayer Pension/Annuity income

Deceased SSN:

8.

8

00

Spouse Pension/Annuity income

Deceased SSN:

9.

9

00

Colorado Source Capital Gain; 5-year assets acquired on or after 5/9/1994

10

Total Contribution $ __________________________

. Tuition Program Contribution: (see instructions)

Owner’s Name ____________________________

10

00

Owner’s SSN

_________________________

11

11

00

. Qualifying Charitable Contribution

Total Contributions $

12

12

00

. Qualified Reservation Income

13

13

00

. PERA/DPSRS Subtraction, for PERA contributions made in 1984–1986 or DPSRS contributions made in 1986

14.

14

00

Railroad Benefit Subtraction, tier I or II only

15.

15

00

Wildfire Mitigation Measures Subtraction

Other Subtractions, explain (see instructions) ____________________________________________

16.

16

00

17.

17

00

Subtotal, add lines 5 through 16

18.

18

00

Colorado Taxable Income, line 4 minus line 17

Tax, Prepayments and Credits: see 104 Booklet for full-year tax table and part-year PN Schedule

19.

19

00

Colorado Tax from tax table or 104PN line 36 (attach 104PN, if applicable)

Staple

20.

20

00

Alternative Minimum Tax from Form 104AMT

W-2,

W2G,

21.

21

00

Recapture of prior year credits

and

22.

22

00

Subtotal, add lines 19 through 21

1099

Forms

23.

23

00

Nonrefundable Credits from 104CR line 49, cannot exceed the sum of lines 19 and 20

Here

24.

24

00

Net Tax, subtract line 23 from line 22

(Only if

Colorado

25.

25

00

CO Income Tax Withheld from W-2s and 1099s. Staple only if line 25 is greater than $0.

tax

26.

Estimated Tax, enter the sum of payments and credits and amounts withheld from

withheld

26

00

nonresident real estate sales and partnership/S corp/fiduciary income

is

reported

27.

27

00

Refundable Credits from 104CR line 9

on the

28.

28

00

Subtotal, add lines 25 through 27

form)

29

. Federal Adjusted Gross Income from your federal income tax form: 1040EZ line 4;

29

00

1040A line 21; 1040 line 37

If you want the Department of Revenue to compute and mail your refund, or compute your balance due and mail a bill, stop

STOP!

here and leave lines 30 through 45 blank. If you want to compute the refund or balance due yourself, continue with line 30.

AMENDED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2