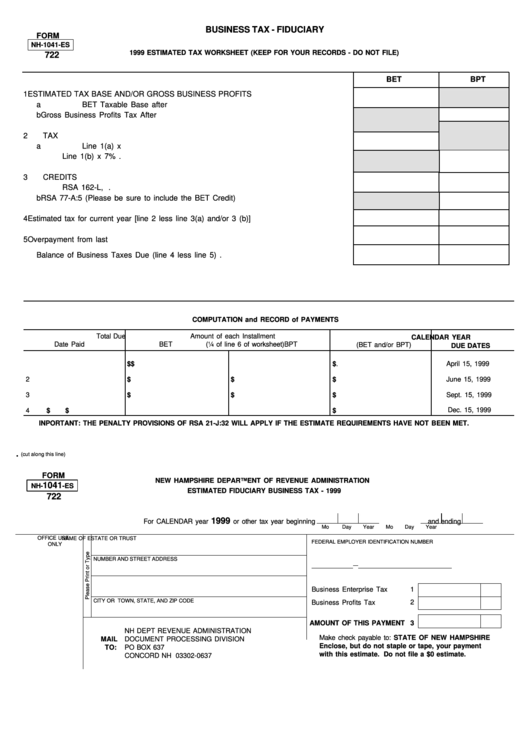

BUSINESS TAX - FIDUCIARY

FORM

NH-1041-ES

1999 ESTIMATED TAX WORKSHEET (KEEP FOR YOUR RECORDS - DO NOT FILE)

722

BET

BPT

1

ESTIMATED TAX BASE AND/OR GROSS BUSINESS PROFITS

a

BET Taxable Base after Apportionment.....................................................................

b

Gross Business Profits Tax After Apportionment........................................................

2

TAX

a

Line 1(a) x .0025.........................................................................................................

b

Line 1(b) x 7%.............................................................................................................

3

CREDITS

a

RSA 162-L, CDFA......................................................................................................

b

RSA 77-A:5 (Please be sure to include the BET Credit)............................................

4

Estimated tax for current year [line 2 less line 3(a) and/or 3 (b)]...........................................

5

Overpayment from last year...................................................................................................

6

Balance of Business Taxes Due (line 4 less line 5)...............................................................

COMPUTATION and RECORD of PAYMENTS

Amount of each Installment

Total Due

CALENDAR YEAR

Date Paid

BET

(¼ of line 6 of worksheet)

BPT

(BET and/or BPT)

DUE DATES

1 ........................................

$ .............................................

$ ............................................

$ ............................................

April 15, 1999

2 ..........................................

$ .............................................

$ ............................................

$ ............................................

June 15, 1999

3 .........................................

$ .............................................

$ ............................................

$ ............................................

Sept. 15, 1999

Dec. 15, 1999

4 ..........................................

$ .............................................

$ ............................................

$ ............................................

INPORTANT: THE PENALTY PROVISIONS OF RSA 21-J:32 WILL APPLY IF THE ESTIMATE REQUIREMENTS HAVE NOT BEEN MET.

..................................................................

..................................................................

(cut along this line)

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

1041

NH-

-ES

ESTIMATED FIDUCIARY BUSINESS TAX - 1999

722

1999

For CALENDAR year

or other tax year beginning

and ending

Mo

Day

Year

Mo

Day

Year

OFFICE USE

NAME OF ESTATE OR TRUST

FEDERAL EMPLOYER IDENTIFICATION NUMBER

ONLY

NUMBER AND STREET ADDRESS

Business Enterprise Tax

1

CITY OR TOWN, STATE, AND ZIP CODE

2

Business Profits Tax

AMOUNT OF THIS PAYMENT

3

NH DEPT REVENUE ADMINISTRATION

Make check payable to: STATE OF NEW HAMPSHIRE

MAIL

DOCUMENT PROCESSING DIVISION

Enclose, but do not staple or tape, your payment

TO:

PO BOX 637

with this estimate. Do not file a $0 estimate.

CONCORD NH 03302-0637

1

1 2

2