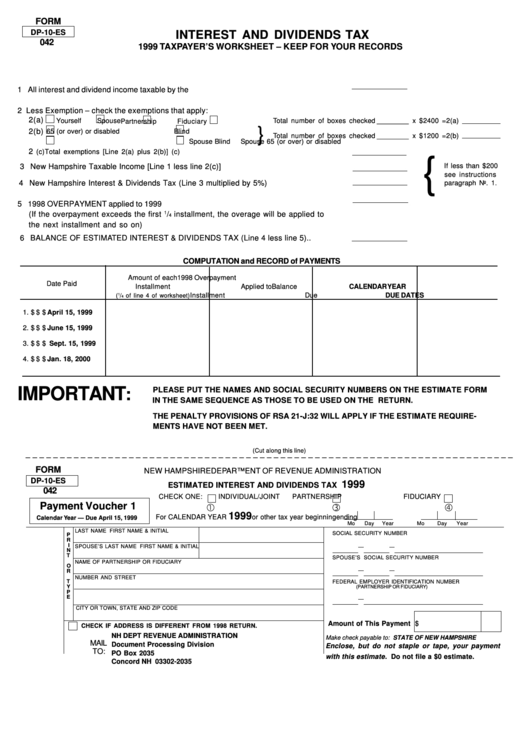

FORM

DP-10-ES

INTEREST AND DIVIDENDS TAX

042

1999 TAXPAYER’S WORKSHEET – KEEP FOR YOUR RECORDS

1 All interest and dividend income taxable by the State...........................................................1

2 Less Exemption – check the exemptions that apply:

2(a)

Yourself

Spouse

Partnership

Fiduciary

Total number of boxes checked ________ x $2400 =2(a)

2(b)

65 (or over) or disabled

Blind

Total number of boxes checked ________ x $1200 =2(b)

Spouse 65 (or over) or disabled

Spouse Blind

2

......2

(c)Total exemptions [Line 2(a) plus 2(b)].............................................................................

(c)

{

3 New Hampshire Taxable Income [Line 1 less line 2(c)]......................................................3

If less than $200

see instructions

4 New Hampshire Interest & Dividends Tax (Line 3 multiplied by 5%).................................4

paragraph No. 1.

5 1998 OVERPAYMENT applied to 1999 taxes......................................................................... 5

1

(If the overpayment exceeds the first

/

installment, the overage will be applied to

4

the next installment and so on)

6 BALANCE OF ESTIMATED INTEREST & DIVIDENDS TAX (Line 4 less line 5)..................6

COMPUTATION and RECORD of PAYMENTS

Amount of each

1998 Overpayment

Date Paid

Installment

Applied to

Balance

CALENDAR YEAR

Installment

Due

DUE DATES

1

(

/

of line 4 of worksheet)

4

1. ..................................

$ ..............................................

$ ..............................................

$ ..............................................

April 15, 1999

2. ..................................

$ ..............................................

$ ..............................................

$ ..............................................

June 15, 1999

3. ..................................

$ ..............................................

$ ..............................................

$ ..............................................

Sept. 15, 1999

4. ..................................

$ ..............................................

$ ..............................................

$ ..............................................

Jan. 18, 2000

IMPORTANT

PLEASE PUT THE NAMES AND SOCIAL SECURITY NUMBERS ON THE ESTIMATE FORM

:

IN THE SAME SEQUENCE AS THOSE TO BE USED ON THE RETURN.

THE PENALTY PROVISIONS OF RSA 21-J:32 WILL APPLY IF THE ESTIMATE REQUIRE-

MENTS HAVE NOT BEEN MET.

(Cut along this line)

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

DP-10-ES

1999

ESTIMATED INTEREST AND DIVIDENDS TAX

042

CHECK ONE:

INDIVIDUAL/JOINT

PARTNERSHIP

FIDUCIARY

Payment Voucher 1

1999

For CALENDAR YEAR

or other tax year beginning

ending

Calendar Year — Due April 15, 1999

Mo

Day

Year

Mo

Day

Year

LAST NAME

FIRST NAME & INITIAL

SOCIAL SECURITY NUMBER

P

R

I

SPOUSE’S LAST NAME

FIRST NAME & INITIAL

N

T

SPOUSE’S SOCIAL SECURITY NUMBER

NAME OF PARTNERSHIP OR FIDUCIARY

O

R

NUMBER AND STREET

T

FEDERAL EMPLOYER IDENTIFICATION NUMBER

Y

(PARTNERSHIP OR FIDUCIARY)

P

E

CITY OR TOWN, STATE AND ZIP CODE

Amount of This Payment $

CHECK IF ADDRESS IS DIFFERENT FROM 1998 RETURN.

NH DEPT REVENUE ADMINISTRATION

Make check payable to: STATE OF NEW HAMPSHIRE

MAIL

Document Processing Division

Enclose, but do not staple or tape, your payment

TO:

PO Box 2035

with this estimate. Do not file a $0 estimate.

Concord NH 03302-2035

1

1 2

2