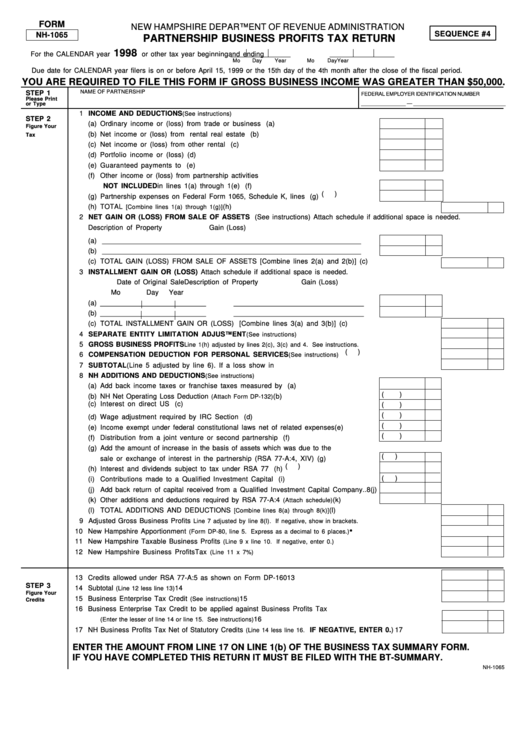

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

SEQUENCE #4

NH-1065

PARTNERSHIP BUSINESS PROFITS TAX RETURN

1998

For the CALENDAR year

or other tax year beginning

and ending

Mo

Day

Year

Mo

Day

Year

Due date for CALENDAR year filers is on or before April 15, 1999 or the 15th day of the 4th month after the close of the fiscal period.

YOU ARE REQUIRED TO FILE THIS FORM IF GROSS BUSINESS INCOME WAS GREATER THAN $50,000.

STEP 1

NAME OF PARTNERSHIP

FEDERAL EMPLOYER IDENTIFICATION NUMBER

Please Print

_______________ — _______________________________

or Type

1 INCOME AND DEDUCTIONS

(See instructions)

STEP 2

(a) Ordinary income or (loss) from trade or business activities...................................1(a)

Figure Your

(b) Net income or (loss) from rental real estate activities...........................................1(b)

Tax

(c) Net income or (loss) from other rental activities....................................................1(c)

(d) Portfolio income or (loss)......................................................................................1(d)

(e) Guaranteed payments to partners.........................................................................1(e)

(f) Other income or (loss) from partnership activities

NOT INCLUDED in lines 1(a) through 1(e) above.................................................1(f)

(

)

(g) Partnership expenses on Federal Form 1065, Schedule K, lines 8-11...................1(g)

(h) TOTAL

.................................................................................................1(h)

[Combine lines 1(a) through 1(g)]

2 NET GAIN OR (LOSS) FROM SALE OF ASSETS (See instructions) Attach schedule if additional space is needed.

Description of Property

Gain (Loss)

(a) ________________________________________________________________

(b) ________________________________________________________________

(c) TOTAL GAIN (LOSS) FROM SALE OF ASSETS [Combine lines 2(a) and 2(b)]...................................2(c)

3 INSTALLMENT GAIN OR (LOSS) Attach schedule if additional space is needed.

Date of Original Sale

Description of Property

Gain (Loss)

Mo

Day

Year

(a) __________________________

________________________________

(b) __________________________

________________________________

(c) TOTAL INSTALLMENT GAIN OR (LOSS) [Combine lines 3(a) and 3(b)]............................................3(c)

4 SEPARATE ENTITY LIMITATION ADJUSTMENT

...........................................................4

(See instructions)

5 GROSS BUSINESS PROFITS

................................5

Line 1(h) adjusted by lines 2(c), 3(c) and 4. See instructions.

(

)

6 COMPENSATION DEDUCTION FOR PERSONAL SERVICES

.........................................6

(See instructions)

7 SUBTOTAL (Line 5 adjusted by line 6). If a loss show in brackets............................................................7

8 NH ADDITIONS AND DEDUCTIONS

(See instructions)

(a) Add back income taxes or franchise taxes measured by income............................8(a)

(

)

(b) NH Net Operating Loss Deduction

...........................................8(b)

(Attach Form DP-132)

(

)

(c) Interest on direct US obligations............................................................................8(c)

(

)

(d) Wage adjustment required by IRC Section 280C....................................................8(d)

(

)

(e) Income exempt under federal constitutional laws net of related expenses..............8(e)

(

)

(f) Distribution from a joint venture or second partnership ..........................................8(f)

(g) Add the amount of increase in the basis of assets which was due to the

(

)

sale or exchange of interest in the partnership (RSA 77-A:4, XIV)..........................8(g)

(h) Interest and dividends subject to tax under RSA 77 ..............................................8(h) (

)

(

)

(i) Contributions made to a Qualified Investment Capital Company..............................8(i)

(j) Add back return of capital received from a Qualified Investment Capital Company..8(j)

(k) Other additions and deductions required by RSA 77-A:4

................8(k)

(Attach schedule)

(l) TOTAL ADDITIONS AND DEDUCTIONS

..............................................8(l)

[Combine lines 8(a) through 8(k)]

9 Adjusted Gross Business Profits

...............................9

Line 7 adjusted by line 8(l). If negative, show in brackets.

•

10 New Hampshire Apportionment

.................................10

(Form DP-80, line 5. Express as a decimal to 6 places.)

11 New Hampshire Taxable Business Profits

.........................................11

(Line 9 x line 10. If negative, enter 0.)

12 New Hampshire Business ProfitsTax

................................................................................12

(Line 11 x 7%)

13 Credits allowed under RSA 77-A:5 as shown on Form DP-160 ....................................................................... 13

STEP 3

14 Subtotal

................................................................................................................................... 14

(Line 12 less line 13)

Figure Your

15 Business Enterprise Tax Credit

................................................................................................ 15

(See instructions)

Credits

16 Business Enterprise Tax Credit to be applied against Business Profits Tax

........................................................................................ 16

(Enter the lesser of line 14 or line 15. See instructions)

17 NH Business Profits Tax Net of Statutory Credits

IF NEGATIVE, ENTER 0.) ............. 17

(Line 14 less line 16.

ENTER THE AMOUNT FROM LINE 17 ON LINE 1(b) OF THE BUSINESS TAX SUMMARY FORM.

IF YOU HAVE COMPLETED THIS RETURN IT MUST BE FILED WITH THE BT-SUMMARY.

NH-1065

1

1 2

2