Instructions For 1999 Form Mo-Ptc Property Tax Credit Claim Page 3

ADVERTISEMENT

during calendar year 1999, you still qualify for the credit even if you are not age 65.

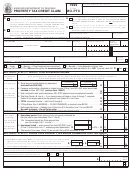

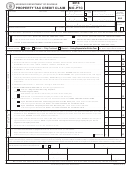

Step 2

Also, you or your spouse must have been a Missouri resident for the entire 1999 calen-

dar year. If claimant would have otherwise qualified for a property tax credit and

Filing Status

would have been a resident for the entire 1999 calendar year, but died before the last

day of the calendar year, the claimant would still qualify for the credit for 1999.

Lines 1 through 3

OR

Check “Single” if you were:(1) single the entire 1999 calendar year; or (2) legally sepa-

rated or divorced as of December 31, 1999.

You may also qualify for this credit if you or your spouse is a veteran of any branch of

Check “Married—Filing Combined” if you were married as of December 31, 1999, and

the armed forces of the United States or this state and you or your spouse became

occupied the same homestead(s) for any part of the 1999 calendar year. Note: Income of

100% disabled as a result of such service. Note: You must enclose a copy of the letter

both spouses must be reported regardless of age.

received from the Department of Veterans Affairs that states your qualifications as a

100% service connected disabled veteran. This letter must state, “To be filed with

Check “Married—Living Separate for Entire Year” if you did not occupy a home-

Form MO-PTC.”

stead with your spouse for any portion of the 1999 calendar year.

OR

Line 4

If you occupied and paid real estate taxes on the same home in 1999 as you did in

If you are under age 65, you may qualify for the credit only if you are disabled as

1982, and filed a 1982 Senior Citizens Credit Claim, check “yes” on Line 4. If you sold

defined in Section 135.010(2), RSMo. Note: Rent must be paid by the claimant.

your home during 1999, or if you rent your homestead, check “no”on Line 4.

Your total household income cannot exceed $25,000. However, if your filing status is

“married filing combined” the total combined household income cannot exceed

Section A: Step 3

$27,000.

Disabled: (as defined in Section 135.010(2), RSMo) The inability to engage in any

Report Your Household Income

substantial gainful activity by reason of any medically determined physical or mental

impairment which can be expected to result in death or which has lasted or can be

Note: Complete only Section A if you did not file a Form MO-1040 and your only sources of

expected to last for a continuous period of not less than 12 months. A claimant shall

income are from social security, pensions and annuities, dividends, interest income or public

not be required to be gainfully employed prior to such disability.

assistance. If you are filing a Form MO-1040, you must complete Section A and Section B. If

you were age 65 or older on or before December 31, 1999 and you are a Missouri

Disabled Verification. If you are under age 65, a doctor must certify that you are dis-

resident, you may qualify for a pharmaceutical tax credit (Section A, Line 16). The

abled by completing Federal Form 1040, Schedule R Instructions, page 4 or Federal

credit exists to offset the cost of legend drugs purchased with a prescription. The

Form 1040A, Schedule 3 Instructions, page 4. You may also verify you are disabled by

credit amount is $200 for each claimant age 65 or older. However, if you are

enclosing a copy of Form SSA-1099, a letter from the Social Security Administration

required to file a Form MO-1040 (because you may need to reduce your credit), you

providing the date of disability or a copy of your Medicare card (not Medicaid card).

must figure your pharmaceutical tax credit on Form MO-1040. Round all amounts

OR

to whole dollars.

You must be 60 years of age or older as of December 31, 1999 (born before 1940) and

Line 5

received surviving spouse social security benefits during 1999. You must enclose a copy

Enter total social security payments and benefits before any deductions as shown on your

of Form SSA-1099. Indicate the decedent’s name and the date of death in the box pro-

Form SSA-1099(s). Enclose a copy of your Form SSA-1099(s).

vided.

Line 6

Note: If two (2) or more qualified individuals (not a married couple) occupy the same

Enter the amount of pensions, annuities, dividends or interest income not included on

homestead, each must file a separate claim and report his/her portion of real estate

Form MO-1040. (Do not include amount of excludable costs of pensions or annuities.)

taxes and/or rent paid.

Enclose a copy of each Form 1099 or 1099R. (If you filed a Form MO-1040 and you

had exempt interest on your federal return or you qualified for an interest subtraction

on your Missouri return, you must include that amount in your household income.)

Enter the amount on Line 6.

Step 1

Line 7

Name(s), Address, Social Security Number(s)

Enter total amount of public relief, public assistance, supplemental security income

(SSI), AFDC payments and unemployment benefits received. (Public assistance

and Birthdate(s)

includes any governmental cash received.) Do not include the value of commodity

foods, food stamps or heating and cooling assistance. Note: If filing a Form MO-

Name(s), Address, Social Security Number(s) and Birthdate(s)

1040, do not include unemployment benefits (already included on Form MO-

Use the label on the cover of the instruction book if all information is correct and print

1040) on Line 7. Enclose a copy of Form SSA-1099, if applicable, or a letter

or type your social security number(s) in the spaces provided. If you did not receive a

from the Social Security Administration that indicates the date of disability

book with a label, or if the label is incorrect, print or type your name(s), address, and

and total yearly income received.

social security number(s) in the spaces provided. If you or your spouse do not have a

Line 8

social security number, enter “none”in the appropriate space(s). Indicate your birth-

Enter amount from Section B, Line H. You must complete Section B if you file a Form

date(s) in the boxes provided. Note: If you are using a label, do not place the label

MO-1040 or you have household income not included on Lines 5, 6 and 7.

over your birthdate(s). If married, enter both birthdates, even if your spouse died

during the calendar year.

Line 9

School District Number

Total Household Income (Add Lines 5 through 8).

Enter the number of the school district in which you live.

Line 10

If filing status Box 2 (Married—Filing Combined) is checked, enter $2,000.

Phone Number

Enter your home telephone number.

Line 11

Amended Return

Net Household Income (Subtract Line 10 from Line 9).

If the total on Line 11 is over $25,000,

Check this box if you are filing an amended return.Complete the entire return using the

No Credit Is Allowed.

corrected figures.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6