Instructions For 1999 Form Mo-Ptc Property Tax Credit Claim Page 4

ADVERTISEMENT

for a pharmaceutical tax credit, but died before the last day of the year, the claimant

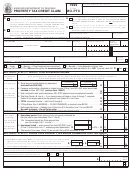

Section A: Step 4

would still qualify for the credit.)

Real Estate Tax or Rent Paid

Line 17

Add Line 15 and Line 16 and enter the total credit or refund on Line 17.

Line 12

Note: If filing a Form MO-1040, enter your property tax credit on Form

Homestead Owned — If you owned and occupied your homestead and paid the real

MO-1040, Line 36. If filing a Form MO-1040, you must figure your pharma-

estate taxes, you must complete Form MO-PTC, Part 1, page 3, to determine your

ceutical tax credit on Form MO-1040.

allowable homestead tax paid and to determine your allowable homestead school

taxes paid for 1999. Enter the amount from Part 1, Line 5. Note: This credit is based

on sole occupancy of your homestead. If you shared your home with relatives and/or

Please Sign Return

friends, enter the appropriate percentage of homestead occupied. Enclose copies of

1999 real estate tax receipts stamped paid to verify homestead tax claimed.

Signature

If your real estate tax is escrowed through your mortgage holder, you must obtain a

You must sign your Missouri property tax credit claim. Both spouses must sign a com-

paid real estate tax receipt from your county collector’s office. If you send only a mort-

bined return. If you pay someone to prepare your return, that person must also sign the

gage statement, your credit or refund will be denied. (If you owned and occupied a

return.

mobile home on which you paid personal property tax, also complete Form MO-PTC,

If you wish to authorize the Director of Revenue or delegate to release information per-

Part 1, page 3.) You must enclose a Form 948, Assessor’s Certification if your

taining to your tax account to your preparer or to any member of his/her firm, indicate

tax receipt is for your home and more than five acres. The property tax credit

“yes”by checking the appropriate box.

claim may only be based on your home and dwelling (not to exceed five acres). Your

county assessor should complete Form 948 upon your request.

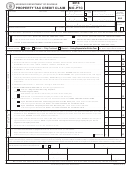

Section B

Line 12a

Enter the homestead school tax from Part 1, Line 5a, on this line. Do not add or sub-

Household Income Not Included in Section A

tract this amount from the total homestead tax.

Complete Section B if you filed a Form MO-1040 or you have income not

Line 13

included on page 1, Section A. Enter the total from Section B, Line H on

Homestead Rented — Complete and enclose one Form MO-CRP, Certification of Rent Paid

Section A, Line 8.

for each rented homestead you occupied during 1999. (If you rented only one homestead,

Form MO-CRP is provided on the back of Form MO-PTC.) Note: This credit is based on sole

Line A

occupancy of your homestead. If you shared your home with relatives and/or friends, enter

If you file a Form MO-1040,enter income from Form MO-1040,Line 6 and skip to Line D.

the appropriate percentage of homestead occupied. Enter the amount from Form MO-CRP,

Line B

Line 7 on Line 13. Multiply that amount by 20% (.20) to determine your allowable rent

equivalent to real estate tax paid. Enclose a copy of your 1999 rent receipt(s) from

If you do not file a Form MO-1040,enter wages,salaries,tips,etc. Enclose all Form W-2(s).

your landlord (including the housing authority, nursing home or residential care

Line C

facility). The landlord must sign the receipt with his/her tax identification or

Complete Form MO-PTC, Part 2, page 4 and enter the total from Line 4 on Line C.

social security number. Copies of cancelled checks will be acceptable if your

Examples of income or loss which must be reported in Part 2, page 4, are rental income

landlord will not provide a rent receipt. If your gross rent paid exceeds your

or loss, royalties, gains or losses from sales of real estate, stocks, bonds, etc.; farm, busi-

household income, enclose a statement verifying how the additional rent was

ness, partnership, fiduciary and miscellaneous income or loss. Enclose schedules

paid. You must provide a detailed explanation. Your claim will be denied if verifi-

where requested.

cation is not enclosed.

Line D

Line 14

Enter total Railroad Retirement Benefits before deductions for medical premiums or

Enter total of Lines 12 and 13. Do not enter more than $750 (the maximum allowed).

withholdings of any kind. (Enclose a copy of your Form RRB-1099, if applicable.)

Line E

Section A: Step 5

Enter total annual veteran’s payments and benefits. Enclose a copy of your Form

Figure Your Property Tax Credit and

1099-R. Note: If you are a 100% service connected disabled veteran you are

not required to list veteran’s payments and benefits. If you are the surviving

Pharmaceutical Tax Credit

spouse of a 100% service connected disabled veteran, all of the veteran’s

benefits must be reported.

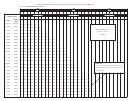

Line 15

Apply amounts on Lines 11 and 14 to the computation table on pages 17 and 18 to deter-

Line F

mine the amount of refund or credit. Enter the credit on Line 15. If you are filing a Form

If you file a Form MO-1040 enter the amount claimed as a subtraction for exempt con-

MO-1040,enter the credit on Form MO-PTC,Line 15 and on Form MO-1040,Line 36.

tributions made to, or earnings from, the Missouri Higher Education Savings Program

(amount from Form MO-A, Part 2, Line 8).

Line 16

If you are required to file a Form MO-1040, you must figure your pharmaceu-

Line G

tical tax credit on Form MO-1040. If filing a Form MO-1040, enter zero (0) on

Enter nonbusiness losses that were claimed on your Form MO-1040. If you did not file a

Line 16. (The pharmaceutical tax credit is based on Missouri adjusted gross income,

Form MO-1040, enter nonbusiness losses that were claimed on Form MO-PTC, Part B, Line

not household income. If you are required to file a Form MO-1040, your credit may

C. If the amount entered on Line C included a nonbusiness loss from Part 2, Page 4, you

need to be reduced, so it must be computed on Form MO-1040.)

must enter the nonbusiness loss from Part 2, Page 4 on Line G. All amounts entered on

this line must be added into household income (not subtracted).

If you are not required to file a Form MO-1040:

Enter $200 for yourself if you were 65 or older as of December 31, 1999 and you are a

Note: Losses from Federal Form 1040, Schedule F are considered business losses. If

Missouri resident. Enter $200 for your spouse if your spouse was 65 or older as of

you included losses on your Form MO-1040, enclose a copy of your federal return with

December 31, 1999 and is a Missouri resident. Enter the total on Line 16. You do not

all schedules.

qualify for the pharmaceutical tax credit if you received full reimbursement for the cost

Line H

of legend drugs, purchased with a prescription, from Medicare or Medicaid or you are a

resident of a local, state or federally funded facility. (If claimant would have qualified

Add Lines A through G. Enter the total on Line H and on Section A, Line 8.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6