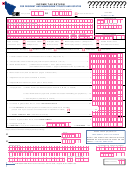

Form 1041me - Income Tax Return For Resident And Nonresident Trusts And Estates - 2004 Page 2

ADVERTISEMENT

FORM 1041ME, page 2 -

Enclose with your Form 1041ME

SCHEDULE 1 - FIDUCIARY ADJUSTMENT

00

(Enter combined amounts for both the beneficiaries and the estate or trust)

*0409111*

1 ADDITIONS — Income exempt from federal income tax, but taxable by Maine law:

,

.00

a Income from municipal and state bonds, other than Maine ............................................................................. 1a

,

.00

b Net Operating Loss Recovery Adjustment (attach schedule) ........................................................................... 1b

,

.00

c Maine State Retirement Contributions .............................................................................................................. 1c

,

.00

d Fiduciary Adjustment-additions only ................................................................................................................. 1d

,

.00

e Bonus Depreciation and IRC §179 Expense Add-back (See instructions) ...................................................... 1e

,

.00

f Other. List _________________________ (See instructions) ....................................................................... 1f

,

.00

g Total additions (add lines 1a through 1f) ........................................................................................................... 1g

2 DEDUCTIONS — Income exempt from Maine income tax, but taxable by federal law:

,

.00

a U.S. Government Bond interest included in federal taxable income ................................................................ 2a

,

.00

b Social Security and Railroad Retirement Benefits included in federal taxable income (see instructions) ...... 2b

,

.00

c Interest from Maine Municipal General Obligation & Private Activity Bonds included in federal taxable income ... 2c

d Maine State Retirement System Pick-Up Contributions paid during 2004

,

.00

which have been previously taxed by the state ................................................................................................ 2d

,

.00

e Federal Work Opportunity Credit/Federal Empowerment Zone Credit ............................................................ 2e

,

.00

f Bonus Depreciation and IRC § 179 Recapture (See instructions) .................................................................... 2f

,

.00

g Other. List ______________________________________ (See instructions) ............................................. 2g

,

.00

h Total Deductions (add lines 2a through 2g) ...................................................................................................... 2h

,

.00

3 Net Fiduciary Adjustment (subtract line 2h from line 1g — see instructions [may be a negative amount]) ........ 3

Resident trusts or estates: If the trust’s/estate’s share of distributable net income is less than 100%, multiply the result of subtracting line 2h from line 1g

($_____________) by Schedule 2, Column 3, line f. Enter result here and on page 1, line 2. Nonresident trusts or estates: Enter total fiduciary adjustment

here and on Schedule NR, line 4. Do not apply the allocation rate from Schedule 2 at this time; the rate will be applied when completing Schedule NR.

SCHEDULE 2 — ALLOCATION OF FEDERAL INCOME AND MAINE-SOURCE INCOME

1. Name

2. Share of income

3. Percent

4. State of

5. Social security

6. Maine-source income allocated

B = beneficiary

(copy from federal return)

domicile

number/EIN of

to nonresident beneficiaries

TE = trust or estate

beneficiaries

(

a

)

B

-

$

%

$

(

b

)

B

-

$

%

$

(

c

)

B

-

$

%

$

(

d

)

B

-

$

%

$

(

e

)

B

-

$

%

$

(

) f

T

E

-

$

%

(

g

)

T

o

t

l a

$

1

0

0

%

$

Nonresident: Line g, column 6: Enter the amount from Schedule NR, line 5, column B. Complete column 6 for nonresident beneficiaries based on

the amount entered on line g, column 6, and also based on the percentages in column 3.

SCHEDULE 3 - CREDIT FOR INCOME TAX PAID TO ANOTHER JURISDICTION

.00

,

1 Maine taxable income from Form 1041ME, page 1, line 3 ..................................................................................... 1

.00

,

2 Income taxed by ( ______________________________ other jurisdiction) included in line 1 ........................... 2

3 Percentage of income taxed by other jurisdiction (divide line 2 by line 1) ............................................................. 3

______________________ %

4 Limitation of credit:

.00

,

a Form 1041ME, page 1, line 4 $ ___________ multiplied by _______ % on line 3 above ........................... 4a

.00

,

b Income taxes paid to other jurisdiction net of tax credits .................................................................................. 4b

.00

,

5 Allowable credit: line 4a or 4b, whichever is less. Enter here and on Form 1041ME, Schedule A, line 4 ........... 5

Special instructions for taxpayers who claim credit for income tax paid to more than one other jurisdiction: Credit for each jurisdiction must be computed separately.

Use a separate Schedule 3 for each one. Add the results together and enter total on Schedule A, line 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2