Instructions - Business Registration Renewal

ADVERTISEMENT

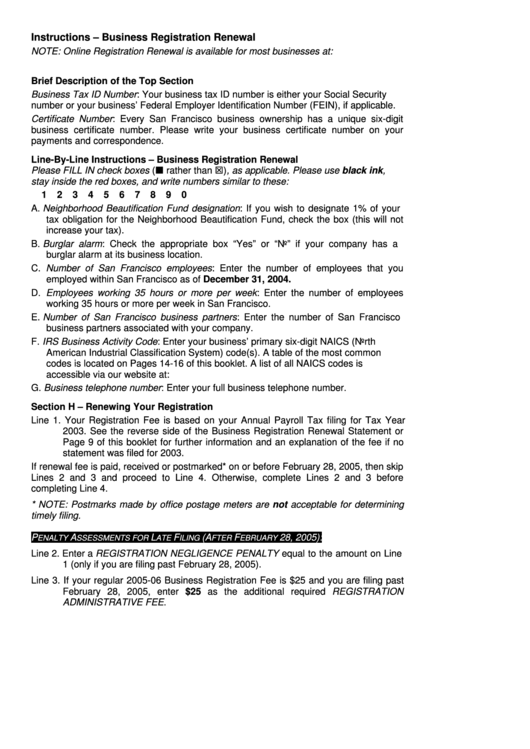

Instructions – Business Registration Renewal

NOTE: Online Registration Renewal is available for most businesses at:

Brief Description of the Top Section

Business Tax ID Number: Your business tax ID number is either your Social Security

number or your business’ Federal Employer Identification Number (FEIN), if applicable.

Certificate Number: Every San Francisco business ownership has a unique six-digit

business certificate number. Please write your business certificate number on your

payments and correspondence.

Line-By-Line Instructions – Business Registration Renewal

Please FILL IN check boxes (

rather than

), as applicable. Please use black ink,

stay inside the red boxes, and write numbers similar to these:

1

2

3

4

5

6

7

8

9

0

A. Neighborhood Beautification Fund designation: If you wish to designate 1% of your

tax obligation for the Neighborhood Beautification Fund, check the box (this will not

increase your tax).

B. Burglar alarm: Check the appropriate box “Yes” or “No” if your company has a

burglar alarm at its business location.

C. Number of San Francisco employees: Enter the number of employees that you

employed within San Francisco as of December 31, 2004.

D. Employees working 35 hours or more per week: Enter the number of employees

working 35 hours or more per week in San Francisco.

E. Number of San Francisco business partners: Enter the number of San Francisco

business partners associated with your company.

F. IRS Business Activity Code: Enter your business’ primary six-digit NAICS (North

American Industrial Classification System) code(s). A table of the most common

codes is located on Pages 14-16 of this booklet. A list of all NAICS codes is

accessible via our website at:

G. Business telephone number: Enter your full business telephone number.

Section H – Renewing Your Registration

Line 1. Your Registration Fee is based on your Annual Payroll Tax filing for Tax Year

2003. See the reverse side of the Business Registration Renewal Statement or

Page 9 of this booklet for further information and an explanation of the fee if no

statement was filed for 2003.

If renewal fee is paid, received or postmarked* on or before February 28, 2005, then skip

Lines 2 and 3 and proceed to Line 4. Otherwise, complete Lines 2 and 3 before

completing Line 4.

* NOTE: Postmarks made by office postage meters are not acceptable for determining

timely filing.

P

A

L

F

(A

F

28, 2005):

ENALTY

SSESSMENTS FOR

ATE

ILING

FTER

EBRUARY

Line 2. Enter a REGISTRATION NEGLIGENCE PENALTY equal to the amount on Line

1 (only if you are filing past February 28, 2005).

Line 3. If your regular 2005-06 Business Registration Fee is $25 and you are filing past

February 28, 2005, enter $25 as the additional required REGISTRATION

ADMINISTRATIVE FEE.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2