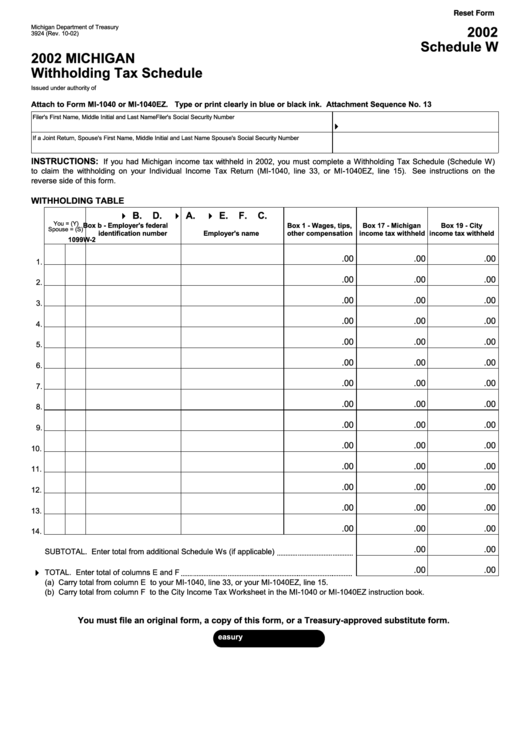

Reset Form

Michigan Department of Treasury

2002

3924 (Rev. 10-02)

Schedule W

2002 MICHIGAN

Withholding Tax Schedule

Issued under authority of P.A. 281 of 1967. Filing is mandatory.

Attach to Form MI-1040 or MI-1040EZ. Type or print clearly in blue or black ink.

Attachment Sequence No. 13

Filer's First Name, Middle Initial and Last Name

Filer's Social Security Number

4

If a Joint Return, Spouse's First Name, Middle Initial and Last Name

Spouse's Social Security Number

INSTRUCTIONS:

If you had Michigan income tax withheld in 2002, you must complete a Withholding Tax Schedule (Schedule W)

to claim the withholding on your Individual Income Tax Return (MI-1040, line 33, or MI-1040EZ, line 15). See instructions on the

reverse side of this form.

WITHHOLDING TABLE

4

A.

4

B.

C.

D.

4

E.

F.

You = (Y)

Box b - Employer's federal

Box 1 - Wages, tips,

Box 17 - Michigan

Box 19 - City

Spouse = (S)

identification number

Employer's name

other compensation

income tax withheld

income tax withheld

W-2

1099

.00

.00

.00

1.

.00

.00

.00

2.

.00

.00

.00

3.

.00

.00

.00

4.

.00

.00

.00

5.

.00

.00

.00

6.

.00

.00

.00

7.

.00

.00

.00

8.

.00

.00

.00

9.

.00

.00

.00

10.

.00

.00

.00

11.

.00

.00

.00

12.

.00

.00

.00

13.

.00

.00

.00

14.

.00

.00

SUBTOTAL. Enter total from additional Schedule Ws (if applicable)

.00

.00

4

TOTAL. Enter total of columns E and F

(a) Carry total from column E to your MI-1040, line 33, or your MI-1040EZ, line 15.

(b) Carry total from column F to the City Income Tax Worksheet in the MI-1040 or MI-1040EZ instruction book.

You must file an original form, a copy of this form, or a Treasury-approved substitute form.

1

1