Name(s) as shown on Page 1

Social Security Number

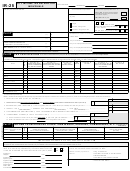

SCHEDULE Y (BUSINESS ALLOCATION FORMULA)

Use this schedule if engaged in business in more than one city and you do not have books and records which will disclose with reasonable accuracy what portion

of the net profits is attributed to that part of the business done within the boundaries of the city or cities involved.

A. Located Everywhere

Step 1. Average net book value of real and tangible personal property................................................................... $

Gross annual rentals multiplied by 8........................................................................................................... $

Total Step 1...................................................................................................................................................................................... $

Step 2. Gross receipts from sales made and work or services performed..................................................................................................... $

Step 3. Total wages, salaries, commissions and other compensation of all employees................................................................................ $

B. List city portion of the above 3 steps in spaces below and compute percentage of each appropriate city (B divided by A)

AVERAGE

TAXABLE INCOME

CITY

STEP 1

STEP 2

STEP 3

PERCENTAGE

Adjusted net income from Page

$

$

$

$

%

2, Schedule C, Line 21 of IR-

COLUMBUS

25.

%

%

%

$

$

$

$

%

$

GROVEPORT

%

%

%

$

$

$

$

%

OBETZ

%

%

%

Multiply this figure by the

average percentage for each

$

$

$

City and enter allocable amount

$

%

CANAL WINCHESTER

by City in the space at the right.

%

%

%

$

$

$

$

%

MARBLE CLIFF

%

%

%

Determine average percentage

by dividing total percentages

$

$

by number of percentages

$

$

%

BRICE

used.

%

%

%

$

$

$

$

%

LITHOPOLIS

%

%

%

$

$

$

$

%

HARRISBURG

%

%

%

Balance of adjusted net income............................................................................................................................................................. $

Total adjusted net income...................................................................................................................................................................... $

IR-25 Page 3/Rev. 10/29/04

1

1 2

2 3

3