Tax Form 310

1998

M

A

P

.

ERCHANDISE OR

GRICULTURAL

RODUCT

F

S

O

OR

TORAGE

NLY

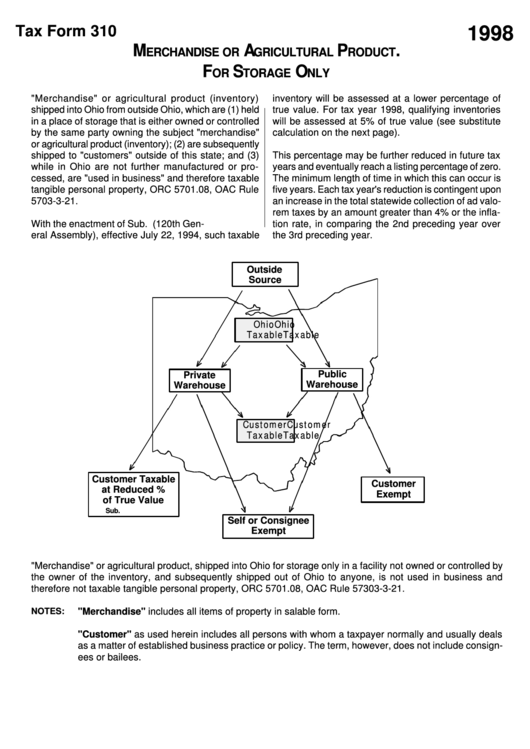

"Merchandise" or agricultural product (inventory)

inventory will be assessed at a lower percentage of

shipped into Ohio from outside Ohio, which are (1) held

true value. For tax year 1998, qualifying inventories

in a place of storage that is either owned or controlled

will be assessed at 5% of true value (see substitute

by the same party owning the subject "merchandise"

calculation on the next page).

or agricultural product (inventory); (2) are subsequently

shipped to "customers" outside of this state; and (3)

This percentage may be further reduced in future tax

while in Ohio are not further manufactured or pro-

years and eventually reach a listing percentage of zero.

cessed, are "used in business" and therefore taxable

The minimum length of time in which this can occur is

tangible personal property, ORC 5701.08, OAC Rule

five years. Each tax year's reduction is contingent upon

5703-3-21.

an increase in the total statewide collection of ad valo-

rem taxes by an amount greater than 4% or the infla-

With the enactment of Sub. H.B. No. 630 (120th Gen-

tion rate, in comparing the 2nd preceding year over

eral Assembly), effective July 22, 1994, such taxable

the 3rd preceding year.

Outside

Source

Ohio

Ohio

Taxable

Taxable

Public

Private

Warehouse

Warehouse

Customer

Customer

Taxable

Taxable

Customer Taxable

Customer

at Reduced %

Exempt

of True Value

Sub. H.B. No. 630

Self or Consignee

Exempt

"Merchandise" or agricultural product, shipped into Ohio for storage only in a facility not owned or controlled by

the owner of the inventory, and subsequently shipped out of Ohio to anyone, is not used in business and

therefore not taxable tangible personal property, ORC 5701.08, OAC Rule 57303-3-21.

NOTES:

"Merchandise" includes all items of property in salable form.

"Customer" as used herein includes all persons with whom a taxpayer normally and usually deals

as a matter of established business practice or policy. The term, however, does not include consign-

ees or bailees.

1

1 2

2