Instructions For Form 541-Qft - California Income Tax Return For Qualified Funeral Trusts - 1998

ADVERTISEMENT

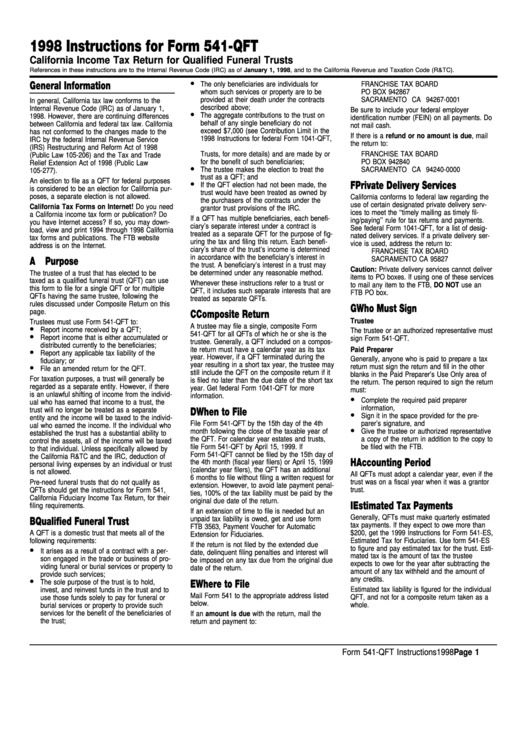

1998 Instructions for Form 541-QFT

California Income Tax Return for Qualified Funeral Trusts

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 1998, and to the California Revenue and Taxation Code (R&TC).

•

General Information

The only beneficiaries are individuals for

FRANCHISE TAX BOARD

whom such services or property are to be

PO BOX 942867

provided at their death under the contracts

SACRAMENTO CA 94267-0001

In general, California tax law conforms to the

described above;

Internal Revenue Code (IRC) as of January 1,

Be sure to include your federal employer

•

The aggregate contributions to the trust on

1998. However, there are continuing differences

identification number (FEIN) on all payments. Do

behalf of any single beneficiary do not

between California and federal tax law. California

not mail cash.

exceed $7,000 (see Contribution Limit in the

has not conformed to the changes made to the

If there is a refund or no amount is due, mail

1998 Instructions for federal Form 1041-QFT,

IRC by the federal Internal Revenue Service

the return to:

U.S. Income Tax Return for Qualified Funeral

(IRS) Restructuring and Reform Act of 1998

Trusts, for more details) and are made by or

FRANCHISE TAX BOARD

(Public Law 105-206) and the Tax and Trade

for the benefit of such beneficiaries;

PO BOX 942840

Relief Extension Act of 1998 (Public Law

•

The trustee makes the election to treat the

SACRAMENTO CA 94240-0000

105-277).

trust as a QFT; and

An election to file as a QFT for federal purposes

•

F Private Delivery Services

If the QFT election had not been made, the

is considered to be an election for California pur-

trust would have been treated as owned by

poses, a separate election is not allowed.

California conforms to federal law regarding the

the purchasers of the contracts under the

use of certain designated private delivery serv-

California Tax Forms on Internet! Do you need

grantor trust provisions of the IRC.

ices to meet the ‘‘timely mailing as timely fil-

a California income tax form or publication? Do

If a QFT has multiple beneficiaries, each benefi-

ing/paying’’ rule for tax returns and payments.

you have Internet access? If so, you may down-

ciary’s separate interest under a contract is

See federal Form 1041-QFT, for a list of desig-

load, view and print 1994 through 1998 California

treated as a separate QFT for the purpose of fig-

nated delivery services. If a private delivery ser-

tax forms and publications. The FTB website

uring the tax and filing this return. Each benefi-

vice is used, address the return to:

address is on the Internet.

ciary’s share of the trust’s income is determined

FRANCHISE TAX BOARD

in accordance with the beneficiary’s interest in

SACRAMENTO CA 95827

A Purpose

the trust. A beneficiary’s interest in a trust may

Caution: Private delivery services cannot deliver

be determined under any reasonable method.

The trustee of a trust that has elected to be

items to PO boxes. If using one of these services

taxed as a qualified funeral trust (QFT) can use

Whenever these instructions refer to a trust or

to mail any item to the FTB, DO NOT use an

this form to file for a single QFT or for multiple

QFT, it includes such separate interests that are

FTB PO box.

QFTs having the same trustee, following the

treated as separate QFTs.

rules discussed under Composite Return on this

G Who Must Sign

page.

C Composite Return

Trustee

Trustees must use Form 541-QFT to:

•

A trustee may file a single, composite Form

Report income received by a QFT;

The trustee or an authorized representative must

•

541-QFT for all QFTs of which he or she is the

Report income that is either accumulated or

sign Form 541-QFT.

trustee. Generally, a QFT included on a compos-

distributed currently to the beneficiaries;

•

ite return must have a calendar year as its tax

Paid Preparer

Report any applicable tax liability of the

year. However, if a QFT terminated during the

Generally, anyone who is paid to prepare a tax

fiduciary; or

•

year resulting in a short tax year, the trustee may

return must sign the return and fill in the other

File an amended return for the QFT.

still include the QFT on the composite return if it

blanks in the Paid Preparer’s Use Only area of

For taxation purposes, a trust will generally be

is filed no later than the due date of the short tax

the return. The person required to sign the return

regarded as a separate entity. However, if there

year. Get federal Form 1041-QFT for more

must:

is an unlawful shifting of income from the individ-

information.

•

Complete the required paid preparer

ual who has earned that income to a trust, the

information,

trust will no longer be treated as a separate

D When to File

•

Sign it in the space provided for the pre-

entity and the income will be taxed to the individ-

File Form 541-QFT by the 15th day of the 4th

parer’s signature, and

ual who earned the income. If the individual who

•

month following the close of the taxable year of

Give the trustee or authorized representative

established the trust has a substantial ability to

the QFT. For calendar year estates and trusts,

a copy of the return in addition to the copy to

control the assets, all of the income will be taxed

file Form 541-QFT by April 15, 1999. If

be filed with the FTB.

to that individual. Unless specifically allowed by

Form 541-QFT cannot be filed by the 15th day of

the California R&TC and the IRC, deduction of

H Accounting Period

the 4th month (fiscal year filers) or April 15, 1999

personal living expenses by an individual or trust

(calendar year filers), the QFT has an additional

is not allowed.

All QFTs must adopt a calendar year, even if the

6 months to file without filing a written request for

trust was on a fiscal year when it was a grantor

Pre-need funeral trusts that do not qualify as

extension. However, to avoid late payment penal-

QFTs should get the instructions for Form 541,

trust.

ties, 100% of the tax liability must be paid by the

California Fiduciary Income Tax Return, for their

original due date of the return.

I

Estimated Tax Payments

filing requirements.

If an extension of time to file is needed but an

Generally, QFTs must make quarterly estimated

unpaid tax liability is owed, get and use form

B Qualified Funeral Trust

tax payments. If they expect to owe more than

FTB 3563, Payment Voucher for Automatic

A QFT is a domestic trust that meets all of the

$200, get the 1999 Instructions for Form 541-ES,

Extension for Fiduciaries.

Estimated Tax for Fiduciaries. Use form 541-ES

following requirements:

If the return is not filed by the extended due

•

to figure and pay estimated tax for the trust. Esti-

It arises as a result of a contract with a per-

date, delinquent filing penalties and interest will

mated tax is the amount of tax the trustee

son engaged in the trade or business of pro-

be imposed on any tax due from the original due

expects to owe for the year after subtracting the

viding funeral or burial services or property to

date of the return.

amount of any tax withheld and the amount of

provide such services;

•

any credits.

The sole purpose of the trust is to hold,

E Where to File

Estimated tax liability is figured for the individual

invest, and reinvest funds in the trust and to

Mail Form 541 to the appropriate address listed

use those funds solely to pay for funeral or

QFT, and not for a composite return taken as a

below.

whole.

burial services or property to provide such

services for the benefit of the beneficiaries of

If an amount is due with the return, mail the

the trust;

return and payment to:

Form 541-QFT Instructions 1998

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3