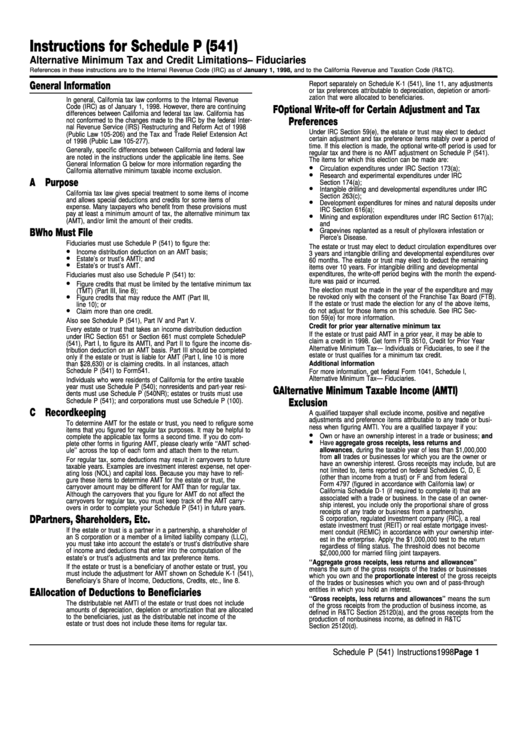

Instructions For Schedule P (541) - Alternative Minimum Tax And Credit Limitations - Fiduciaries

ADVERTISEMENT

Instructions for Schedule P (541)

Alternative Minimum Tax and Credit Limitations – Fiduciaries

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 1998, and to the California Revenue and Taxation Code (R&TC).

Report separately on Schedule K-1 (541), line 11, any adjustments

General Information

or tax preferences attributable to depreciation, depletion or amorti-

zation that were allocated to beneficiaries.

In general, California tax law conforms to the Internal Revenue

Code (IRC) as of January 1, 1998. However, there are continuing

F Optional Write-off for Certain Adjustment and Tax

differences between California and federal tax law. California has

not conformed to the changes made to the IRC by the federal Inter-

Preferences

nal Revenue Service (IRS) Restructuring and Reform Act of 1998

Under IRC Section 59(e), the estate or trust may elect to deduct

(Public Law 105-206) and the Tax and Trade Relief Extension Act

certain adjustment and tax preference items ratably over a period of

of 1998 (Public Law 105-277).

time. If this election is made, the optional write-off period is used for

Generally, specific differences between California and federal law

regular tax and there is no AMT adjustment on Schedule P (541).

are noted in the instructions under the applicable line items. See

The items for which this election can be made are:

General Information G below for more information regarding the

•

Circulation expenditures under IRC Section 173(a);

California alternative minimum taxable income exclusion.

•

Research and experimental expenditures under IRC

A Purpose

Section 174(a);

•

Intangible drilling and developmental expenditures under IRC

California tax law gives special treatment to some items of income

Section 263(c);

•

and allows special deductions and credits for some items of

Development expenditures for mines and natural deposits under

expense. Many taxpayers who benefit from these provisions must

IRC Section 616(a);

•

pay at least a minimum amount of tax, the alternative minimum tax

Mining and exploration expenditures under IRC Section 617(a);

(AMT), and/or limit the amount of their credits.

and

•

Grapevines replanted as a result of phylloxera infestation or

B Who Must File

Pierce’s Disease.

Fiduciaries must use Schedule P (541) to figure the:

The estate or trust may elect to deduct circulation expenditures over

•

Income distribution deduction on an AMT basis;

3 years and intangible drilling and developmental expenditures over

•

Estate’s or trust’s AMTI; and

60 months. The estate or trust may elect to deduct the remaining

•

Estate’s or trust’s AMT.

items over 10 years. For intangible drilling and developmental

expenditures, the write-off period begins with the month the expend-

Fiduciaries must also use Schedule P (541) to:

•

iture was paid or incurred.

Figure credits that must be limited by the tentative minimum tax

The election must be made in the year of the expenditure and may

(TMT) (Part III, line 8);

•

be revoked only with the consent of the Franchise Tax Board (FTB).

Figure credits that may reduce the AMT (Part III,

If the estate or trust made the election for any of the above items,

line 10); or

•

do not adjust for those items on this schedule. See IRC Sec-

Claim more than one credit.

tion 59(e) for more information.

Also see Schedule P (541), Part IV and Part V.

Credit for prior year alternative minimum tax

Every estate or trust that takes an income distribution deduction

If the estate or trust paid AMT in a prior year, it may be able to

under IRC Section 651 or Section 661 must complete Schedule P

claim a credit in 1998. Get form FTB 3510, Credit for Prior Year

(541), Part I, to figure its AMTI, and Part II to figure the income dis-

Alternative Minimum Tax — Individuals or Fiduciaries, to see if the

tribution deduction on an AMT basis. Part III should be completed

estate or trust qualifies for a minimum tax credit.

only if the estate or trust is liable for AMT (Part I, line 10 is more

than $28,630) or is claiming credits. In all instances, attach

Additional information

Schedule P (541) to Form 541.

For more information, get federal Form 1041, Schedule I,

Alternative Minimum Tax — Fiduciaries.

Individuals who were residents of California for the entire taxable

year must use Schedule P (540); nonresidents and part-year resi-

G Alternative Minimum Taxable Income (AMTI)

dents must use Schedule P (540NR); estates or trusts must use

Schedule P (541); and corporations must use Schedule P (100).

Exclusion

C Recordkeeping

A qualified taxpayer shall exclude income, positive and negative

adjustments and preference items attributable to any trade or busi-

To determine AMT for the estate or trust, you need to refigure some

ness when figuring AMTI. You are a qualified taxpayer if you:

items that you figured for regular tax purposes. It may be helpful to

•

Own or have an ownership interest in a trade or business; and

complete the applicable tax forms a second time. If you do com-

•

Have aggregate gross receipts, less returns and

plete other forms in figuring AMT, please clearly write ‘‘AMT sched-

allowances, during the taxable year of less than $1,000,000

ule’’ across the top of each form and attach them to the return.

from all trades or businesses for which you are the owner or

For regular tax, some deductions may result in carryovers to future

have an ownership interest. Gross receipts may include, but are

taxable years. Examples are investment interest expense, net oper-

not limited to, items reported on federal Schedules C, D, E

ating loss (NOL) and capital loss. Because you may have to refi-

(other than income from a trust) or F and from federal

gure these items to determine AMT for the estate or trust, the

Form 4797 (figured in accordance with California law) or

carryover amount may be different for AMT than for regular tax.

California Schedule D-1 (if required to complete it) that are

Although the carryovers that you figure for AMT do not affect the

associated with a trade or business. In the case of an owner-

carryovers for regular tax, you must keep track of the AMT carry-

ship interest, you include only the proportional share of gross

overs in order to complete your Schedule P (541) in future years.

receipts of any trade or business from a partnership,

D Partners, Shareholders, Etc.

S corporation, regulated investment company (RIC), a real

estate investment trust (REIT) or real estate mortgage invest-

If the estate or trust is a partner in a partnership, a shareholder of

ment conduit (REMIC) in accordance with your ownership inter-

an S corporation or a member of a limited liability company (LLC),

est in the enterprise. Apply the $1,000,000 test to the return

you must take into account the estate’s or trust’s distributive share

regardless of filing status. The threshold does not become

of income and deductions that enter into the computation of the

$2,000,000 for married filing joint taxpayers.

estate’s or trust’s adjustments and tax preference items.

‘‘Aggregate gross receipts, less returns and allowances’’

If the estate or trust is a beneficiary of another estate or trust, you

means the sum of the gross receipts of the trades or businesses

must include the adjustment for AMT shown on Schedule K-1 (541),

which you own and the proportionate interest of the gross receipts

Beneficiary’s Share of Income, Deductions, Credits, etc., line 8.

of the trades or businesses which you own and of pass-through

entities in which you hold an interest.

E Allocation of Deductions to Beneficiaries

‘‘Gross receipts, less returns and allowances’’ means the sum

The distributable net AMTI of the estate or trust does not include

of the gross receipts from the production of business income, as

amounts of depreciation, depletion or amortization that are allocated

defined in R&TC Section 25120(a), and the gross receipts from the

to the beneficiaries, just as the distributable net income of the

production of nonbusiness income, as defined in R&TC

estate or trust does not include these items for regular tax.

Section 25120(d).

Schedule P (541) Instructions 1998

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6