Instructions For Annual Reconciliation Of Wage Tax - City Of Philadelphia - 1999

ADVERTISEMENT

Instructions for 1999 Annual Reconciliation of Wage Tax

WHERE TO FILE: Mail this return and W-2(s), disk or tape to:

City of Philadelphia

Department of Revenue

P.O. Box 1670

Philadelphia, PA 19105-1670

•

The Annual Reconciliation of Wage Tax Withheld for the year 1999 is due on or before

February 29, 2000.

•

Failure to file this return by the due date could result in imposition of fines and legal costs.

•

Place your Federal Identification Number in the space provided if it was not preprinted.

•

All compensation paid to residents is taxable, even if earned outside of Philadelphia.

•

Compensation paid to nonresidents is taxable only if earned within Philadelphia.

•

To ensure efficient processing, print your numbers legibly.

•

If the tax due on line 12 is more than $1, make check payable to “City of Philadelphia”. Do not

pay tax if less than $1.

•

Tax Overpaid: Refund petitions must be filed for any employer refunds. Refunds/credits will not

be granted to employers where the overpayment appears to have resulted from overwithholding

of tax on employee compensation.

•

Photocopies of this form are not acceptable. Do not use correction fluids for changes.

•

Direct telephone inquiries to 215-686-6600. Send e-mail to revenue@phila.gov

•

Visit our web site:

MAGNETIC MEDIA W-2 REPORTING: Employers with more than 250 employees must remit

W-2 data on magnetic media. The record format is to be the same as transmitted to the Social

Security Administration, as stated in SSA Pub. No. 42-007, including A, B, E, W and S records.

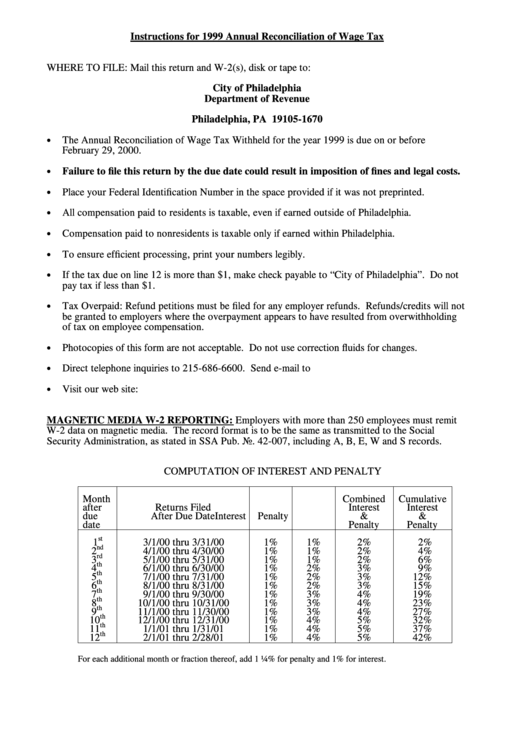

COMPUTATION OF INTEREST AND PENALTY

Month

Combined

Cumulative

after

Returns Filed

Interest

Interest

due

After Due Date

Interest

Penalty

&

&

date

Penalty

Penalty

st

1

3/1/00 thru 3/31/00

1%

1%

2%

2%

nd

2

4/1/00 thru 4/30/00

1%

1%

2%

4%

rd

3

5/1/00 thru 5/31/00

1%

1%

2%

6%

th

4

6/1/00 thru 6/30/00

1%

2%

3%

9%

th

5

7/1/00 thru 7/31/00

1%

2%

3%

12%

th

6

8/1/00 thru 8/31/00

1%

2%

3%

15%

th

7

9/1/00 thru 9/30/00

1%

3%

4%

19%

th

8

10/1/00 thru 10/31/00

1%

3%

4%

23%

th

9

11/1/00 thru 11/30/00

1%

3%

4%

27%

th

10

12/1/00 thru 12/31/00

1%

4%

5%

32%

th

11

1/1/01 thru 1/31/01

1%

4%

5%

37%

th

12

2/1/01 thru 2/28/01

1%

4%

5%

42%

For each additional month or fraction thereof, add 1 ¼% for penalty and 1% for interest.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1