Annual Reconciliation Employer Wage Tax Form - City Of Philadelphia - 2011

ADVERTISEMENT

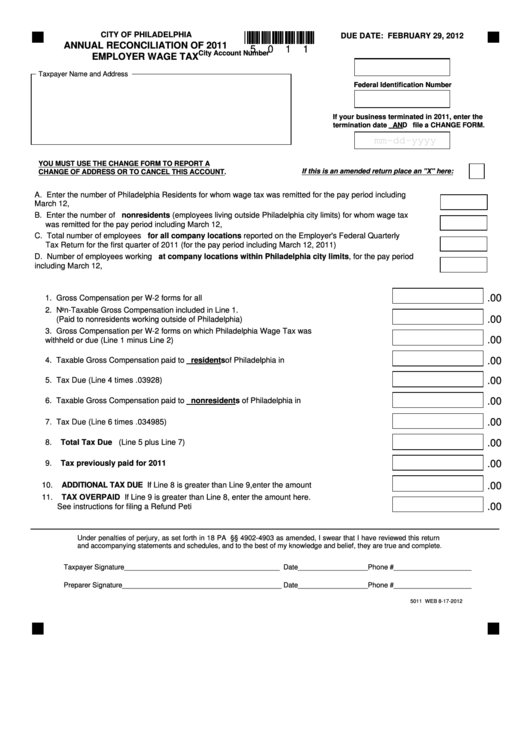

CITY OF PHILADELPHIA

DUE DATE: FEBRUARY 29, 2012

ANNUAL RECONCILIATION OF 2011

5

0

1

1

City Account Number

EMPLOYER WAGE TAX

Taxpayer Name and Address

Federal Identification Number

If your business terminated in 2011, enter the

termination date AND file a CHANGE FORM.

mm-dd-yyyy

YOU MUST USE THE CHANGE FORM TO REPORT A

If this is an amended return place an "X" here:

CHANGE OF ADDRESS OR TO CANCEL THIS ACCOUNT.

A. Enter the number of Philadelphia Residents for whom wage tax was remitted for the pay period including

March 12, 2011.....................................................................................................................................................A.

B. Enter the number of nonresidents (employees living outside Philadelphia city limits) for whom wage tax

was remitted for the pay period including March 12, 2011...................................................................................B.

C. Total number of employees for all company locations reported on the Employer's Federal Quarterly

Tax Return for the first quarter of 2011 (for the pay period including March 12, 2011)........................................C.

D. Number of employees working at company locations within Philadelphia city limits, for the pay period

including March 12, 2011......................................................................................................................................D.

.00

1. Gross Compensation per W-2 forms for all employees......................................................1.

2. Non-Taxable Gross Compensation included in Line 1.

.00

(Paid to nonresidents working outside of Philadelphia)......................................................2.

3. Gross Compensation per W-2 forms on which Philadelphia Wage Tax was

.00

withheld or due (Line 1 minus Line 2).................................................................................3.

.00

4. Taxable Gross Compensation paid to residents of Philadelphia in 2011..........................4.

.00

5. Tax Due (Line 4 times .03928)............................................................................................5.

.00

6. Taxable Gross Compensation paid to nonresidents of Philadelphia in 2011...................6.

.00

7. Tax Due (Line 6 times .034985)..........................................................................................7.

.00

8. Total Tax Due (Line 5 plus Line 7).....................................................................................8.

.00

9. Tax previously paid for 2011............................................................................................9.

10. ADDITIONAL TAX DUE If Line 8 is greater than Line 9, enter the amount here.....................10.

.00

11. TAX OVERPAID If Line 9 is greater than Line 8, enter the amount here.

.00

See instructions for filing a Refund Petition...............................................................................11.

Under penalties of perjury, as set forth in 18 PA C.S. §§ 4902-4903 as amended, I swear that I have reviewed this return

and accompanying statements and schedules, and to the best of my knowledge and belief, they are true and complete.

Taxpayer Signature________________________________________ Date__________________Phone #____________________

Preparer Signature_________________________________________ Date__________________Phone #____________________

5011 WEB 8-17-2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1