For Office Use Only

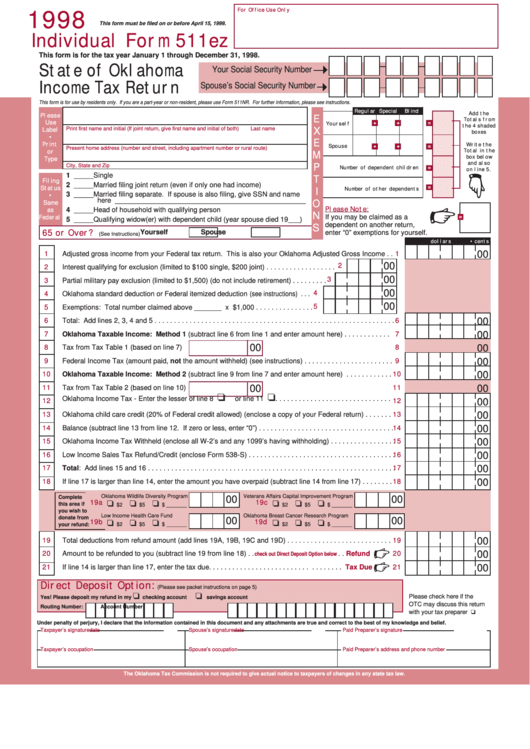

1998

This form must be filed on or before April 15, 1999.

Individual Form 511ez

This form is for the tax year January 1 through December 31, 1998.

State of Oklahoma

Your Social Security Number

Spouse’s Social Security Number

Income Tax Return

This form is for use by residents only. If you are a part-year or non-resident, please use Form 511NR. For further information, please see instructions.

Regular Special

Blind

Add the

Please

E

Totals from

+

+

=

Use

Yourself

the 4 shaded

Print first name and initial (If joint return, give first name and initial of both)

Last name

Label

X

boxes

•

E

Print

Write the

+

+

=

Spouse

Present home address (number and street, including apartment number or rural route)

Total in the

or

M

box below

Type

and also

City, State and Zip

P

=

Number of dependent children

on line 5.

1 _____ Single

T

Filing

2 _____ Married filing joint return (even if only one had income)

=

Status

Number of other dependents

I

3 _____ Married filing separate. If spouse is also filing, give SSN and name

•

here _________________________________________________

O

Same

4 _____ Head of household with qualifying person

Please Note:

as

N

If you may be claimed as a

=

Federal

5 _____ Qualifying widow(er) with dependent child (year spouse died 19___)

dependent on another return,

S

Yourself

Spouse

enter “0” exemptions for yourself.

E

65 or Over?

(See Instructions)

dollars

• cents

00

Adjusted gross income from your Federal tax return. This is also your Oklahoma Adjusted Gross Income . .

1

1

00

2

Interest qualifying for exclusion (limited to $100 single, $200 joint) . . . . . . . . . . . . . . . . . .

2

00

3

Partial military pay exclusion (limited to $1,500) (do not include retirement) . . . . . . . . .

3

00

Oklahoma standard deduction or Federal itemized deduction (see instructions) . . .

4

4

00

Exemptions: Total number claimed above _______ x $1,000 . . . . . . . . . . . . . . .

5

5

Total: Add lines 2, 3, 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

6

6

00

Oklahoma Taxable Income: Method 1 (subtract line 6 from line 1 and enter amount here) . . . . . . . . . . . .

7

7

00

00

Tax from Tax Table 1 (based on line 7)

8

8

00

Federal Income Tax (amount paid, not the amount withheld) (see instructions) . . . . . . . . . . . . . . . . . . . . . . .

9

9

00

Oklahoma Taxable Income: Method 2 (subtract line 9 from line 7 and enter amount here) . . . . . . . . . . . .

10

10

00

00

Tax from Tax Table 2 (based on line 10)

11

11

00

Oklahoma Income Tax - Enter the lesser of line 8

or line 11

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

12

00

Oklahoma child care credit (20% of Federal credit allowed) (enclose a copy of your Federal return) . . . . . . .

13

13

00

Balance (subtract line 13 from line 12. If zero or less, enter “0”) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

14

00

Oklahoma Income Tax Withheld (enclose all W-2’s and any 1099’s having withholding) . . . . . . . . . . . . . . . . .

15

15

00

Low Income Sales Tax Refund/Credit (enclose Form 538-S) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

16

00

Total: Add lines 15 and 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

17

00

If line 17 is larger than line 14, enter the amount you have overpaid (subtract line 14 from line 17) . . . . . . . .

18

18

Oklahoma Wildlife Diversity Program

Veterans Affairs Capital Improvement Program

Complete

00

00

19a

19c

this area if

$2

$5

$ _______

$2

$5

$ _______

you wish to

Low Income Health Care Fund

Oklahoma Breast Cancer Research Program

donate from

00

00

19b

19d

$2

$5

$ _______

$2

$5

$ _______

your refund:

00

Total deductions from refund amount (add lines 19A, 19B, 19C and 19D) . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

19

00

Amount to be refunded to you (subtract line 19 from line 18) . .

. .

Refund

20

20

check out Direct Deposit Option below

00

If line 14 is larger than line 17, enter the tax due. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Tax Due

21

21

Direct Deposit Option:

(Please see packet instructions on page 5)

Please check here if the

Yes! Please deposit my refund in my

checking account

savings account

OTC may discuss this return

Routing Number:

Account Number:

with your tax preparer

Under penalty of perjury, I declare that the information contained in this document and any attachments are true and correct to the best of my knowledge and belief.

Taxpayer’s signature

date

Spouse’s signature

date

Paid Preparer’s signature

I.D. Number

Taxpayer’s occupation

Spouse’s occupation

Paid Preparer’s address and phone number

The Oklahoma Tax Commission is not required to give actual notice to taxpayers of changes in any state tax law.

1

1