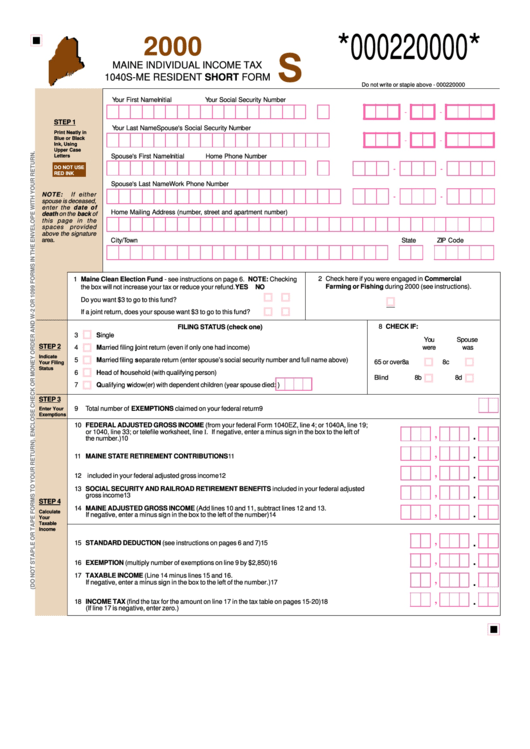

Maine Individual Income Tax 1040s-Me Resident Short Form - 2000

ADVERTISEMENT

*000220000*

2000

MAINE INDIVIDUAL INCOME TAX

1040S-ME RESIDENT SHORT FORM

Do not write or staple above - 000220000

Your First Name

Initial

Your Social Security Number

-

-

STEP 1

Your Last Name

Spouse's Social Security Number

Print Neatly in

Blue or Black

-

-

Ink, Using

Upper Case

Letters

Spouse's First Name

Initial

Home Phone Number

DO NOT USE

-

-

RED INK

Spouse's Last Name

Work Phone Number

NOTE:

If either

-

-

spouse is deceased,

enter the date of

Home Mailing Address (number, street and apartment number)

death on the back of

this page in the

spaces provided

above the signature

area.

City/Town

State

ZIP Code

2 Check here if you were engaged in Commercial

1 Maine Clean Election Fund - see instructions on page 6. NOTE: Checking

Farming or Fishing during 2000 (see instructions).

the box will not increase your tax or reduce your refund.

YES

NO

Do you want $3 to go to this fund? ...........................................

If a joint return, does your spouse want $3 to go to this fund? ....

8 CHECK IF:

FILING STATUS (check one)

3

Single

You

Spouse

STEP 2

4

Married filing joint return (even if only one had income)

were

was

Indicate

5

Married filing separate return (enter spouse’s social security number and full name above)

65 or over

8a

8c

Your Filing

Status

6

Head of household (with qualifying person)

Blind

8b

8d

7

Qualifying widow(er) with dependent children (year spouse died:

)

STEP 3

9

Total number of EXEMPTIONS claimed on your federal return .............................................................................................................. 9

Enter Your

Exemptions

10 FEDERAL ADJUSTED GROSS INCOME (from your federal Form 1040EZ, line 4; or 1040A, line 19;

or 1040, line 33; or telefile worksheet, line I. If negative, enter a minus sign in the box to the left of

,

.

the number.) ............................................................................................................................................ 10

,

.

11 MAINE STATE RETIREMENT CONTRIBUTIONS ................................................................................... 11

,

.

12 U.S. GOVERNMENT BOND INTEREST included in your federal adjusted gross income ............................ 12

13 SOCIAL SECURITY AND RAILROAD RETIREMENT BENEFITS included in your federal adjusted

,

.

gross income ........................................................................................................................................... 13

STEP 4

14 MAINE ADJUSTED GROSS INCOME (Add lines 10 and 11, subtract lines 12 and 13.

,

Calculate

.

If negative, enter a minus sign in the box to the left of the number) .............................................................. 14

Your

Taxable

Income

,

.

15 STANDARD DEDUCTION (see instructions on pages 6 and 7) ........................................................................ 15

,

.

16 EXEMPTION (multiply number of exemptions on line 9 by $2,850) ................................................................... 16

17 TAXABLE INCOME (Line 14 minus lines 15 and 16.

,

.

If negative, enter a minus sign in the box to the left of the number.) ................................................................... 17

,

.

18 INCOME TAX (find the tax for the amount on line 17 in the tax table on pages 15-20) ........................................ 18

(If line 17 is negative, enter zero.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2