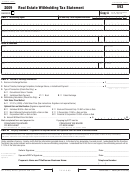

Instructions For Form 593 - Real Estate Withholding Tax Statement - 2017 Page 2

ADVERTISEMENT

Specific Instructions

E

Amending Form 593

We assess a penalty for failure to file complete,

correct, and timely information returns. The

An amended Form 593 can only be filed by the

penalty is calculated per seller:

Instructions for Seller/Transferor

REEP. If a seller/transferor notices an error,

• $30 if filed 1 to 30 days after the due date.

contact the REEP.

This withholding of tax does not relieve you of

• $60 if filed 31 days to 6 months after the due

If you need to amend a previously filed

the requirement to file a California income tax

date.

return and report the sale.

Form 593 and need assistance, call the

• $100 if filed more than 6 months after the

Withholding Services and Compliance telephone

You may be assessed penalties if:

due date.

service at: 888.792.4900 or 916.845.4900.

(R&TC Section 19183)

• You do not file a tax return.

To amend a Form 593 previously filed on the

• You file your tax return late.

If the failure is due to an intentional disregard

correct year form, but reporting incorrect

• The amount of withholding does not satisfy

of the requirement, the penalty is the greater of

information:

your tax liability.

$250 or 10% of the required withholding.

• Complete a new Form 593 with the correct

For more information, get FTB 1150.

How to Claim the Withholding

information. Use the same year form as

Penalties referenced in this section will be

originally filed, and check the “Amended”

To claim the withholding credit, report the

assessed unless it is shown that the failure to

box on the top left corner of the form.

sale/transfer as required and enter the amount

notify, withhold, or timely furnish returns was

• Attach a letter to the back of Form 593

from Form 593, line 5 on your California tax

due to reasonable cause.

explaining what changes were made and

return as withholding from Form(s) 592-B or

why.

593. If your filing status changed after escrow

G

Electronic Filing

• Do not attach the original Form 593.

closed and before filing your California tax

Requirements

return, please call the FTB at 888.792.4900 prior

To amend a Form 593 previously filed using an

to filing your tax return for instructions on how

Form 593 information may be filed with the FTB

incorrect year form, call us for assistance.

to claim your withholding credit. Claim your

electronically, using FTB’s Secure Web Internet

Mail the Form(s) 593 and letter(s) to the

withholding credit on one of the following:

File Transfer (SWIFT). However, the REEP must

address indicated under General Information D,

continue to provide the seller/transferor with a

• Form 540, California Resident Income Tax

When and Where to File.

copy of Form 593.

Return

Whenever an amended Form 593 is filed with

• Form 540NR Long, California Nonresident or

For installment sales, the REEP must also

the FTB, provide a copy to the seller/transferor.

Part-Year Resident Income Tax Return

mail a completed Form 593-

and a copy of

I

Do not file an amended Form 593 to cancel

• Form 541, California Fiduciary Income Tax

the promissory note to the FTB with the down

the withholding amount for a Form 593-C,

Return

payment only.

Real Estate Withholding Certificate, filed after

• Form 100, California Corporation Franchise

For electronic filing, submit your file using the

the close of escrow. After escrow has closed,

or Income Tax Return

SWIFT process as outlined in FTB Pub. 923,

amounts withheld may be recovered only by

• Form 100S, California S Corporation

Secure Web Internet File Transfer (SWIFT) Guide

claiming the withholding as a credit on the

Franchise or Income Tax Return

for Resident, Nonresident, and Real Estate

appropriate year’s tax return. Get Form 593-C

• Form 100W, California Corporation Franchise

Withholding.

for more information.

or Income Tax Return – Water’s-Edge Filers

For the required file format and record layout

• Form 109, California Exempt Organization

F

Interest and Penalties

for electronic filing, get FTB Pub. 1023R, Real

Business Income Tax Return

Estate Withholding Electronic Submission

Interest will be assessed on late withholding

• Form 565, Partnership Return of Income

Requirements. If you are the preparer for more

payments and is computed from the due date

• Form 568, Limited Liability Company Return

than one REEP, provide a separate electronic file

to the date paid. If the REEP does not notify

of Income

for each REEP. For electronic filing, submit your

the buyer/transferee, other than a QI, of the

Attach one copy of Form(s) 593, to the lower

payment using Electronic Funds Transfer (EFT)

withholding requirements in writing, the penalty

front of your California tax return. Make a copy

or Form 593-V.

is the greater of $500 or 10% of the required

for your records.

withholding.

When remitting payments by EFT, mail a

If withholding was done for a failed exchange

copy of Form 593 to the address in General

If after notification, the buyer/transferee, unless

or on boot in the year following the year the

Information D, When and Where to File.

the buyer is a QI in a deferred exchange, does

property was sold, the withholding is shown

not withhold, the penalty is the greater of $500

Electronic signatures shall be considered as

as a credit for the taxable year the withholding

or 10% of the required withholding.

valid as the originals.

occurred since you qualify for installment sale

If the REEP does not furnish complete

reporting. If you elect to report the gain in the

and correct copies of Form 593 to the

year the property was sold, instead of in the

seller/transferor by the due date, the penalty

year you received the payment, contact the FTB

is $100 per Form 593. If the failure is due to

at 888.792.4900 prior to filing your California

an intentional disregard of the requirement, the

tax return for instructions to have the credit

penalty is the greater of $250 or 10% of the

transferred to the prior year.

required withholding.

Real Estate W/H Forms Booklet 2016 Page 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4