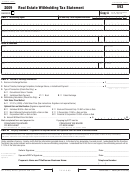

Instructions For Form 593 - Real Estate Withholding Tax Statement - 2017 Page 3

ADVERTISEMENT

Instructions for Withholding Agent

• Non-grantor trust, enter the name of the

Conventional Sale/Transfer: Check this box if

non-grantor trust and the non-grantor trust’s

the conventional sale/transfer represents the

Private Mail Box (PMB) – Include the PMB in

FEIN. If the non-grantor trust has not applied

close of escrow for the real estate transaction.

the address field. Write "PMB" first, then the box

for a FEIN, leave the identification number

This sale/transfer does not contain any

number. Example: 111 Main Street PMB 123.

blank. Do not enter the trustee information.

conditions such as an installment sale, boot, or

Foreign Address – Follow the country’s practice

When the non-grantor trust receives their

failed exchange.

for entering the city, county, province, state,

FEIN, contact the FTB at 888.792.4900.

Installment Sale Payment: Check this box to

country, and postal code, as applicable, in

• Single member limited liability company,

report the sale or transfer as an installment

the appropriate boxes. Do not abbreviate the

enter the name and identification number of

sale if there will be at least one payment made

country name.

the single member.

after the tax year of the sale or transfer, or if

For all other non-individual sellers/transferors,

you are withholding on the down payment or

Part I – Withholding Agent

enter the FEIN, CA Corp number, or CA SOS

principal portion of any installment payment.

Information

file number.

Attach a copy of the promissory note with the

down payment only. At the close of escrow, if

Enter the business or individual name,

Enter the address (or parcel number and

no down payment is received, submit Form 593

identification number, and address of the party

county) of the California real property

with Part III, Line 3, B, Installment Sale Payment

responsible for closing the transaction or any

transferred.

checked and $0 reported on Line 5, Amount

other party who receives and disburses payment

Conventional Sale/Transfer and Installment

Withheld from this Seller/Transferor.

and remits withholding to the FTB for the sale of

Sale: Enter the address (parcel number and

real property.

Boot: Check this box if the seller/transferor

county) of the transferred property.

intends to complete a deferred exchange, but

Enter a business name or individual name,

Exchange: Enter the address of the relinquished

receives boot (cash or cash equivalent) out of

not both. If the party is an escrow company,

property.

escrow.

title company, exchange company, corporation,

partnership, limited liability company,

Part III – Escrow or Exchange

Failed Exchange: Check this box for any

non-grantor trust, or estate, enter the business

failed exchange, including if a failed deferred

Information

name and business identification number (FEIN,

exchange had boot withheld upon in the original

CA Corp no., CA SOS file no.). If the business

Line 1 – Escrow or Exchange Number

relinquished property.

name is not applicable, include the individual's

Enter the escrow or exchange number for the

Line 4 – Withholding Calculation

or grantor's first name, initial, last name, and

property transferred. Do not include dashes

Check one box that represents the method to

identification number (SSN or ITIN).

and/or spaces in the escrow or exchange number.

be used to calculate the withholding amount

Line 2 – Date of Transfer, Exchange

Part II – Seller/Transferor

on line 5. Either the Total Sales Price Method

Completion, Failed Exchange, or Installment

(3

/

% (.0333) of the total sales price, boot, or

1

3

Information

Payment. If the date is left blank, we will use

installment sale payment) or the Optional Gain

a default date of January 1 of the tax year in

Enter the individual or business name (if

on Sale Election based on the applicable tax

which the Form 593 is received. Penalties may

applicable), mailing address, and identification

rate as applied to the gain on sale. Check only

apply for failure to file a complete, correct,

number of the seller/transferor. If the

one box, A-G. Trusts (Grantor and Non-grantor)

and timely information return. For additional

seller/transferor has applied for an identification

check box 4B. The trust's highest tax rate

information, see General Information F, Interest

number, but it has not been received,

is 12.3%.

and Penalties.

enter, “Applied For” in the space for the

Line 5 – Amount Withheld from this

seller’s/transferor's ID and attach a copy of the

Conventional Sale/Transfer: Enter the date

Seller/Transferor

federal application behind Form 593. After the

escrow closed.

Enter the amount withheld from this transaction

identification number is received, call the FTB at

or installment payment based upon the

Exchange: For completed exchanges, enter the

888.792.4900.

appropriate calculation for either the Total Sales

date that the boot (cash or cash equivalent)

If the seller/transferor is a/an:

Price Method or the Optional Gain on Sale

was distributed to the exchanger. For failed

Election, below.

exchanges, enter the date when it was

• Individual, enter the SSN or ITIN. If the

determined that the exchange would not meet

sellers/transferors are husband/RDP

Withholding Calculation Using

the deferred exchange requirements and any

and wife/RDP and plan to file a joint

Total Sales Price Method

cash was distributed to the seller/transferor.

return, enter the name and SSN or ITIN

for each spouse/RDP. Otherwise, do

When withholding on boot or a failed exchange,

Conventional Sale/Transfer:

not enter information for more than one

be sure to use the forms for the year that you

a. Total Sales Price . . . . . . . . . .$__________

seller/transferor. Instead, complete a

entered on line 2 (rather than the year of the

separate Form 593 for each seller/transferor.

sale), since the seller/transferor will be able to

b. Enter the seller’s/transferor's

• Business, enter the business name in

use installment sale reporting for the gain.

ownership percentage . . . . . . _ _ _ ._ _%

the business name field along with the

Installment Sale: For withholding on the down

c. Amount Subject to Withholding.

federal employer identification number

payment, enter the date escrow closed. For

Multiply line a by line b and

(FEIN), California Corporation number

withholding on the principal portion of each

enter the result . . . . . . . . . .$__________

(CA Corp no.), or California Secretary of

installment payment, enter the due date of the

d. Withholding Amount. Multiply

State (CA SOS) file number.

installment payment.

line c by 3

/

% (.0333) and

1

3

• Grantor trust, enter the grantor’s individual

Line 3 – Type of Transaction

enter the result here and on

name and SSN or ITIN. Do not enter the

Check one box that represents the type of real

Form 593, line 5 . . . . . . . . . .$__________

name of the grantor trust. The grantor

estate transaction for which the withholding is

trust is disregarded for tax purposes and

being calculated.

the individual seller/transferor must report

the sale and claim the withholding on the

grantor's individual tax return.

Page 8 Real Estate W/H Forms Booklet 2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4