Annual Reconciliation Of Wage Tax Form - City Of Philadelphia

ADVERTISEMENT

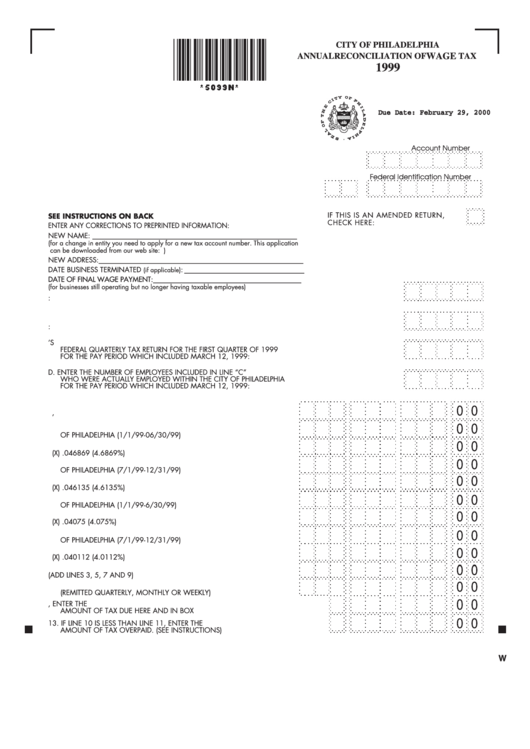

CITY OF PHILADELPHIA

ANNUAL RECONCILIATION OF

WAGE

TAX

1999

Due Date: February 29, 2000

Account Number

Federal Identification Number

IF THIS IS AN AMENDED RETURN,

SEE INSTRUCTIONS ON BACK

CHECK HERE: ................................

ENTER ANY CORRECTIONS TO PREPRINTED INFORMATION:

NEW NAME:

__________________________________________________________

(for a change in entity you need to apply for a new tax account number. This application

can be downloaded from our web site: )

NEW ADDRESS:__________________________________________________________

DATE BUSINESS TERMINATED

)

: __________________________________

(if applicable

DATE OF FINAL WAGE PAYMENT: __________________________________________

(for businesses still operating but no longer having taxable employees)

A. ENTER NUMBER OF PHILADELPHIA RESIDENT EMPLOYEES INCLUDED IN LINE 1:....................................... A.

B. ENTER NUMBER OF NONRESIDENT EMPLOYEES INCLUDED IN LINE 1:.................................................... B.

C. ENTER THE EMPLOYEE COUNT WHICH YOU ENTERED ON YOUR EMPLOYER’S

FEDERAL QUARTERLY TAX RETURN FOR THE FIRST QUARTER OF 1999

FOR THE PAY PERIOD WHICH INCLUDED MARCH 12, 1999: ................................................................... C.

D. ENTER THE NUMBER OF EMPLOYEES INCLUDED IN LINE “C”

WHO WERE ACTUALLY EMPLOYED WITHIN THE CITY OF PHILADELPHIA

FOR THE PAY PERIOD WHICH INCLUDED MARCH 12, 1999: ................................................................... D.

1. GROSS COMPENSATION PER W2’S......................................................1.

2. TOTAL TAXABLE COMPENSATION PAID TO RESIDENTS

OF PHILADELPHIA (1/1/99-06/30/99) ..................................................2.

3. LINE 2 (X) .046869 (4.6869%) ..............................................................3.

4. TOTAL TAXABLE COMPENSATION PAID TO RESIDENTS

OF PHILADELPHIA (7/1/99-12/31/99) ..................................................4.

5. LINE 4 (X) .046135 (4.6135%) ..............................................................5.

6. TOTAL TAXABLE COMPENSATION PAID TO NONRESIDENTS

OF PHILADELPHIA (1/1/99-6/30/99) ....................................................6.

7. LINE 6 (X) .04075 (4.075%) ..................................................................7.

8. TOTAL TAXABLE COMPENSATION PAID TO NONRESIDENTS

OF PHILADELPHIA (7/1/99-12/31/99) ..................................................8.

9. LINE 8 (X) .040112 (4.0112%) ..............................................................9.

10. TOTAL TAX DUE (ADD LINES 3, 5, 7 AND 9) .........................................10.

11. TAX PREVIOUSLY PAID FOR 1999

(REMITTED QUARTERLY, MONTHLY OR WEEKLY)....................................11.

12. IF LINE 10 IS GREATER THAN LINE 11, ENTER THE

AMOUNT OF TAX DUE HERE AND IN BOX A .......................................................12.

13. IF LINE 10 IS LESS THAN LINE 11, ENTER THE

AMOUNT OF TAX OVERPAID. (SEE INSTRUCTIONS) .............................................13.

W

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1