Instructions For Completing Form Ef-101 - Authorization For Electronic Funds Transfer

ADVERTISEMENT

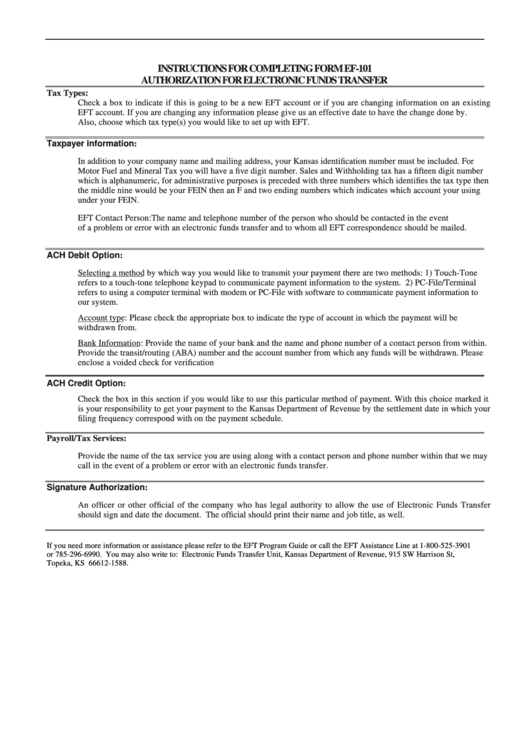

INSTRUCTIONS FOR COMPLETING FORM EF-101

AUTHORIZATION FOR ELECTRONIC FUNDS TRANSFER

Tax Types:

Check a box to indicate if this is going to be a new EFT account or if you are changing information on an existing

EFT account. If you are changing any information please give us an effective date to have the change done by.

Also, choose which tax type(s) you would like to set up with EFT.

Taxpayer information:

In addition to your company name and mailing address, your Kansas identification number must be included. For

Motor Fuel and Mineral Tax you will have a five digit number. Sales and Withholding tax has a fifteen digit number

which is alphanumeric, for administrative purposes is preceded with three numbers which identifies the tax type then

the middle nine would be your FEIN then an F and two ending numbers which indicates which account your using

under your FEIN.

EFT Contact Person:

The name and telephone number of the person who should be contacted in the event

of a problem or error with an electronic funds transfer and to whom all EFT correspondence should be mailed.

ACH Debit Option:

Selecting a method by which way you would like to transmit your payment there are two methods: 1) Touch-Tone

refers to a touch-tone telephone keypad to communicate payment information to the system. 2) PC-File/Terminal

refers to using a computer terminal with modem or PC-File with software to communicate payment information to

our system.

Account type: Please check the appropriate box to indicate the type of account in which the payment will be

withdrawn from.

Bank Information: Provide the name of your bank and the name and phone number of a contact person from within.

Provide the transit/routing (ABA) number and the account number from which any funds will be withdrawn. Please

enclose a voided check for verification

ACH Credit Option:

Check the box in this section if you would like to use this particular method of payment. With this choice marked it

is your responsibility to get your payment to the Kansas Department of Revenue by the settlement date in which your

filing frequency correspond with on the payment schedule.

Payroll/Tax Services:

Provide the name of the tax service you are using along with a contact person and phone number within that we may

call in the event of a problem or error with an electronic funds transfer.

Signature Authorization:

An officer or other official of the company who has legal authority to allow the use of Electronic Funds Transfer

should sign and date the document. The official should print their name and job title, as well.

If you need more information or assistance please refer to the EFT Program Guide or call the EFT Assistance Line at 1-800-525-3901

or 785-296-6990. You may also write to: Electronic Funds Transfer Unit, Kansas Department of Revenue, 915 SW Harrison St,

Topeka, KS 66612-1588.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1