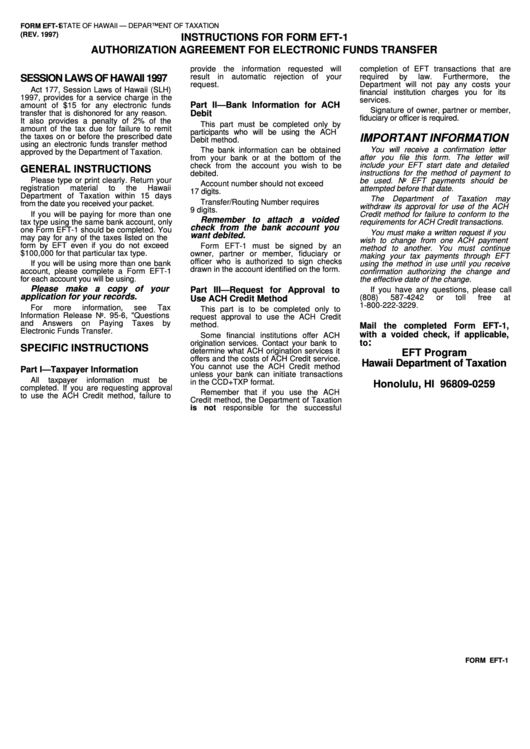

Instructions For Form Eft-1 Authorization Agreement For Electronic Funds Transfer

ADVERTISEMENT

FORM EFT-1

STATE OF HAWAII — DEPARTMENT OF TAXATION

(REV. 1997)

INSTRUCTIONS FOR FORM EFT-1

AUTHORIZATION AGREEMENT FOR ELECTRONIC FUNDS TRANSFER

provide the information requested will

completion of EFT transactions that are

result in automatic rejection of your

required

by

law.

Furthermore,

the

SESSION LAWS OF HAWAII 1997

request.

Department will not pay any costs your

Act 177, Session Laws of Hawaii (SLH)

financial institution charges you for its

1997, provides for a service charge in the

services.

Part II—Bank Information for ACH

amount of $15 for any electronic funds

Signature of owner, partner or member,

transfer that is dishonored for any reason.

Debit

fiduciary or officer is required.

It also provides a penalty of 2% of the

This part must be completed only by

amount of the tax due for failure to remit

participants who will be using the ACH

the taxes on or before the prescribed date

IMPORTANT INFORMATION

Debit method.

using an electronic funds transfer method

You will receive a confirmation letter

The bank information can be obtained

approved by the Department of Taxation.

after you file this form. The letter will

from your bank or at the bottom of the

include your EFT start date and detailed

check from the account you wish to be

GENERAL INSTRUCTIONS

instructions for the method of payment to

debited.

Please type or print clearly. Return your

be used. No EFT payments should be

Account number should not exceed

registration

material

to

the

Hawaii

attempted before that date.

17 digits.

Department of Taxation within 15 days

The

Department

of

Taxation

may

Transfer/Routing Number requires

from the date you received your packet.

withdraw its approval for use of the ACH

9 digits.

If you will be paying for more than one

Credit method for failure to conform to the

Remember to attach a voided

tax type using the same bank account, only

requirements for ACH Credit transactions.

check from the bank account you

one Form EFT-1 should be completed. You

You must make a written request if you

want debited.

may pay for any of the taxes listed on the

wish to change from one ACH payment

form by EFT even if you do not exceed

Form EFT-1 must be signed by an

method to another. You must continue

$100,000 for that particular tax type.

owner, partner or member, fiduciary or

making your tax payments through EFT

officer who is authorized to sign checks

If you will be using more than one bank

using the method in use until you receive

drawn in the account identified on the form.

account, please complete a Form EFT-1

confirmation authorizing the change and

for each account you will be using.

the effective date of the change.

Please make a copy of your

Part III—Request for Approval to

If you have any questions, please call

application for your records.

(808)

587-4242

or

toll

free

at

Use ACH Credit Method

1-800-222-3229.

For

more

information,

see

Tax

This part is to be completed only to

Information Release No. 95-6, "Questions

request approval to use the ACH Credit

and

Answers

on

Paying

Taxes

by

method.

Mail the completed Form EFT-1,

Electronic Funds Transfer.

with a voided check, if applicable,

Some financial institutions offer ACH

:

to

origination services. Contact your bank to

SPECIFIC INSTRUCTIONS

determine what ACH origination services it

EFT Program

offers and the costs of ACH Credit service.

Hawaii Department of Taxation

You cannot use the ACH Credit method

Part I—Taxpayer Information

P.O. Box 259

unless your bank can initiate transactions

All

taxpayer

information

must

be

in the CCD+TXP format.

Honolulu, HI 96809-0259

completed. If you are requesting approval

Remember that if you use the ACH

to use the ACH Credit method, failure to

Credit method, the Department of Taxation

is not responsible for the successful

FORM EFT-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1