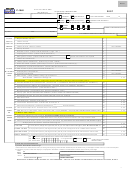

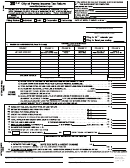

CITY OF PORTLAND

Schedule PY

PART-YEAR RESIDENT TAX CALCULATION

ATTACH THIS SCHEDULE TO YOUR P-1040 FORM

Taxpayer's social security #

Spouse's social security #

First Name and Initial

Last Name

PART-YEAR RESIDENT

From

To

Taxpayer

Spouse

FORMER ADDRESS

Taxpayer

Spouse

COMPUTATION OF TAXABLE INCOME

COLUMN 1

COLUMN 2

PORTLAND INCOME

ALL INCOME EARNED

PORTLAND INCOME

INCOME

TAX WITHHELD

WHILE A RESIDENT

WHILE A

OF PORTLAND

NONRESIDENT

EMPLOYER'S NAME

ADDRESS OF ACTUAL WORK STATION

1.

2.

3.

4.

5.

6.

Total compensation and Portland tax withheld. (Add lines 1 through 6)

Enter on line 30 of P-1040.

7. Interest Income

8.

Dividend income from federal return.

Business and farming income.

9a.

From line 13, P-1040 (Attach fed sch c and /or FED SCH. F)

Sale and exchange of property.

9b.

NOT TAXABLE

From line 8, P-1040 (Attach Fed. Sch. D. and/or Fed. Sch Form 4797)

Farm income or (loss).

9c.

(Attach federal Schedule F.)

9d.

Unemployment compensation.

NOT TAXABLE

NOT TAXABLE

10. Social security benefits.

NOT TAXABLE

NOT TAXABLE

Other income. Attach statement listing type and amount.

11.

Total income. Add lines 1 through 11.

12.

DEDUCTIONS

See instructions. Deductions must be allocated on the same basis as related income.

Individual Retirement Account deduction.

(ATTACH PG. 1 OF FED RETURN)

13

Self Employed SEP, SIMPLE and qualified plans.

(ATTACH COPY OF PG. 1 OF FED. RETURN.)

14

Employee business expenses

(SEE INSTRUCTIONS AND ATTACH FEDERAL 2106 OR LIST.)

15

Moving expenses. -Into Portland only-

(ATTACH FEDERAL FORM 3903.)

16

Alimony paid.

DO NOT INCLUDE CHILD SUPPORT

(ATTACH PG 1 OF FED. TAX RETURN ALONG WITH THE

17

NAME, ADDRESS AND SSN OF PERSON YOU ARE PAYING.)

18

Other, explain and attach forms/schedules

19

Total deductions. Add lines 13 through 18

20

Total income after deductions. Subtract line 19 from line 12

21

Exemption Amount (Number of Exemptions,_____times $1000.00)

22

Total income subject to tax Subtract line 21 from line 20

23a

Tax at resident rate.

(MULTIPLY LINE 22 BY 1% (.01))

23b

Tax at nonresident rate.

(MULTIPLY LINE 20 Column 2 BY 1/2% (.005))

24

Total tax. Add lines 23a and 23b (ENTER HERE AND ON PAGE ONE OF THE P-1040, LINE 29)

Page 8

1

1 2

2