Instructions For Partnership Income Tax Return Arizona Form 165 1998

ADVERTISEMENT

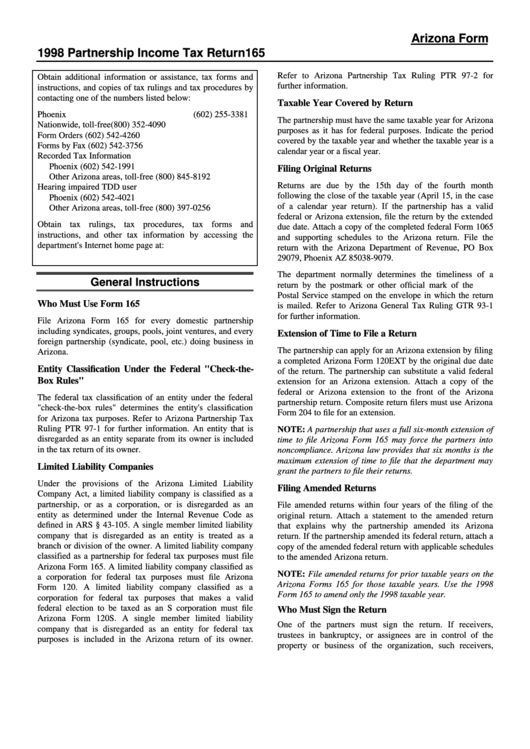

Arizona Form

1998 Partnership Income Tax Return

165

Refer to Arizona Partnership Tax Ruling PTR 97-2 for

Obtain additional information or assistance, tax forms and

further information.

instructions, and copies of tax rulings and tax procedures by

contacting one of the numbers listed below:

Taxable Year Covered by Return

Phoenix

(602) 255-3381

The partnership must have the same taxable year for Arizona

Nationwide, toll-free

(800) 352-4090

purposes as it has for federal purposes. Indicate the period

Form Orders

(602) 542-4260

covered by the taxable year and whether the taxable year is a

Forms by Fax

(602) 542-3756

calendar year or a fiscal year.

Recorded Tax Information

Phoenix

(602) 542-1991

Filing Original Returns

Other Arizona areas, toll-free

(800) 845-8192

Returns are due by the 15th day of the fourth month

Hearing impaired TDD user

following the close of the taxable year (April 15, in the case

Phoenix

(602) 542-4021

of a calendar year return). If the partnership has a valid

Other Arizona areas, toll-free

(800) 397-0256

federal or Arizona extension, file the return by the extended

Obtain tax rulings, tax procedures, tax forms and

due date. Attach a copy of the completed federal Form 1065

instructions, and other tax information by accessing the

and supporting schedules to the Arizona return. File the

department's Internet home page at:

return with the Arizona Department of Revenue, PO Box

29079, Phoenix AZ 85038-9079.

The department normally determines the timeliness of a

General Instructions

return by the postmark or other official mark of the U.S.

Postal Service stamped on the envelope in which the return

Who Must Use Form 165

is mailed. Refer to Arizona General Tax Ruling GTR 93-1

for further information.

File Arizona Form 165 for every domestic partnership

including syndicates, groups, pools, joint ventures, and every

Extension of Time to File a Return

foreign partnership (syndicate, pool, etc.) doing business in

The partnership can apply for an Arizona extension by filing

Arizona.

a completed Arizona Form 120EXT by the original due date

Entity Classification Under the Federal "Check-the-

of the return. The partnership can substitute a valid federal

Box Rules"

extension for an Arizona extension. Attach a copy of the

federal or Arizona extension to the front of the Arizona

The federal tax classification of an entity under the federal

partnership return. Composite return filers must use Arizona

"check-the-box rules" determines the entity's classification

Form 204 to file for an extension.

for Arizona tax purposes. Refer to Arizona Partnership Tax

Ruling PTR 97-1 for further information. An entity that is

NOTE: A partnership that uses a full six-month extension of

disregarded as an entity separate from its owner is included

time to file Arizona Form 165 may force the partners into

in the tax return of its owner.

noncompliance. Arizona law provides that six months is the

maximum extension of time to file that the department may

Limited Liability Companies

grant the partners to file their returns.

Under the provisions of the Arizona Limited Liability

Filing Amended Returns

Company Act, a limited liability company is classified as a

partnership, or as a corporation, or is disregarded as an

File amended returns within four years of the filing of the

entity as determined under the Internal Revenue Code as

original return. Attach a statement to the amended return

defined in ARS § 43-105. A single member limited liability

that explains why the partnership amended its Arizona

company that is disregarded as an entity is treated as a

return. If the partnership amended its federal return, attach a

branch or division of the owner. A limited liability company

copy of the amended federal return with applicable schedules

classified as a partnership for federal tax purposes must file

to the amended Arizona return.

Arizona Form 165. A limited liability company classified as

NOTE: File amended returns for prior taxable years on the

a corporation for federal tax purposes must file Arizona

Arizona Forms 165 for those taxable years. Use the 1998

Form 120. A limited liability company classified as a

Form 165 to amend only the 1998 taxable year.

corporation for federal tax purposes that makes a valid

federal election to be taxed as an S corporation must file

Who Must Sign the Return

Arizona Form 120S. A single member limited liability

One of the partners must sign the return. If receivers,

company that is disregarded as an entity for federal tax

trustees in bankruptcy, or assignees are in control of the

purposes is included in the Arizona return of its owner.

property or business of the organization, such receivers,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8