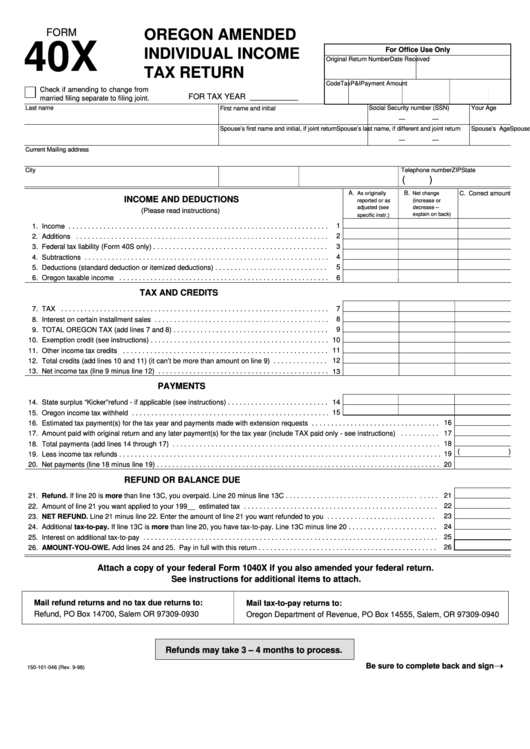

FORM

OREGON AMENDED

40X

For Office Use Only

INDIVIDUAL INCOME

Original Return Number

Date Received

TAX RETURN

Code

Tax

P&I

Payment Amount

Check if amending to change from

FOR TAX YEAR ___________

married filing separate to filing joint.

Last name

Social Security number (SSN)

Your Age

First name and initial

—

—

Spouse’s last name, if different and joint return

Spouse’s first name and initial, if joint return

Spouse’s SSN if joint return

Spouse’s Age

—

—

Current Mailing address

City

State

ZIP

Telephone number

(

)

A.

B.

C. Correct amount

As originally

Net change

INCOME AND DEDUCTIONS

reported or as

(increase or

adjusted (see

decrease –

(Please read instructions)

explain on back)

specific instr.)

1. Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

2. Additions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3. Federal tax liability (Form 40S only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4. Subtractions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5. Deductions (standard deduction or itemized deductions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Oregon taxable income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

TAX AND CREDITS

7

7. TAX . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8. Interest on certain installment sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9. TOTAL OREGON TAX (add lines 7 and 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

10. Exemption credit (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Other income tax credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12

12. Total credits (add lines 10 and 11) (it can’t be more than amount on line 9) . . . . . . . . . . . . . .

13. Net income tax (line 9 minus line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

PAYMENTS

14. State surplus “Kicker”refund - if applicable (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15

15. Oregon income tax withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

16. Estimated tax payment(s) for the tax year and payments made with extension requests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

17. Amount paid with original return and any later payment(s) for the tax year (include TAX paid only - see instructions) . . . . . . . . . .

18

18. Total payments (add lines 14 through 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(

)

19. Less income tax refunds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20. Net payments (line 18 minus line 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

REFUND OR BALANCE DUE

21

21. Refund. If line 20 is more than line 13C, you overpaid. Line 20 minus line 13C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22. Amount of line 21 you want applied to your 199__ estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23

23. NET REFUND. Line 21 minus line 22. Enter the amount of line 21 you want refunded to you . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

24. Additional tax-to-pay. If line 13C is more than line 20, you have tax-to-pay. Line 13C minus line 20 . . . . . . . . . . . . . . . . . . . . . . .

25

25. Interest on additional tax-to-pay . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

26. AMOUNT-YOU-OWE. Add lines 24 and 25. Pay in full with this return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Attach a copy of your federal Form 1040X if you also amended your federal return.

See instructions for additional items to attach.

Mail refund returns and no tax due returns to:

Mail tax-to-pay returns to:

Refund, PO Box 14700, Salem OR 97309-0930

Oregon Department of Revenue, PO Box 14555, Salem, OR 97309-0940

Refunds may take 3 – 4 months to process.

Be sure to complete back and sign

150-101-046 (Rev. 9-98)

1

1 2

2