Form 518 - Mesa Schedule C - Michigan Business Activity And Location Information

ADVERTISEMENT

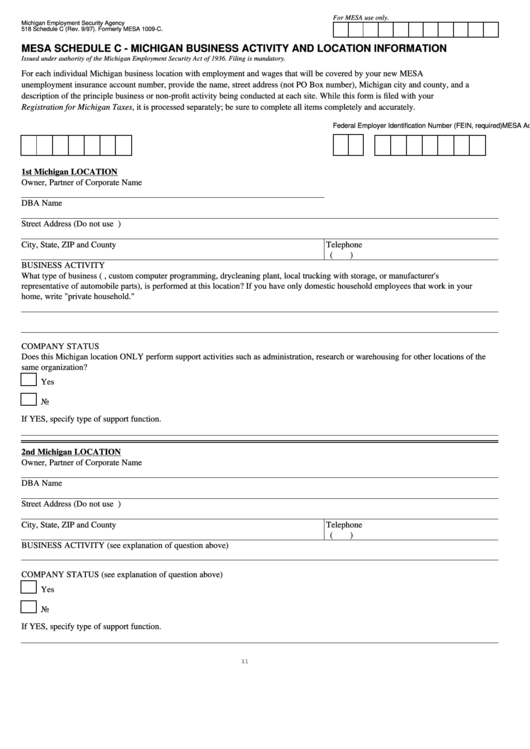

For MESA use only.

Michigan Employment Security Agency

518 Schedule C (Rev. 9/97). Formerly MESA 1009-C.

MESA SCHEDULE C - MICHIGAN BUSINESS ACTIVITY AND LOCATION INFORMATION

Issued under authority of the Michigan Employment Security Act of 1936. Filing is mandatory.

For each individual Michigan business location with employment and wages that will be covered by your new MESA

unemployment insurance account number, provide the name, street address (not PO Box number), Michigan city and county, and a

description of the principle business or non-profit activity being conducted at each site. While this form is filed with your

Registration for Michigan Taxes, it is processed separately; be sure to complete all items completely and accurately.

MESA Account Number, if already assigned

Federal Employer Identification Number (FEIN, required)

1st Michigan LOCATION

Owner, Partner of Corporate Name

DBA Name

Street Address (Do not use P.O. Box)

City, State, ZIP and County

Telephone

(

)

BUSINESS ACTIVITY

What type of business (e.g., custom computer programming, drycleaning plant, local trucking with storage, or manufacturer's

representative of automobile parts), is performed at this location? If you have only domestic household employees that work in your

home, write "private household."

COMPANY STATUS

Does this Michigan location ONLY perform support activities such as administration, research or warehousing for other locations of the

same organization?

Yes

No

If YES, specify type of support function.

2nd Michigan LOCATION

Owner, Partner of Corporate Name

DBA Name

Street Address (Do not use P.O. Box)

City, State, ZIP and County

Telephone

(

)

BUSINESS ACTIVITY (see explanation of question above)

COMPANY STATUS (see explanation of question above)

Yes

No

If YES, specify type of support function.

11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2