Form Gt-300089 - A Guide To Filing And Paying Florida Taxes Electronically

ADVERTISEMENT

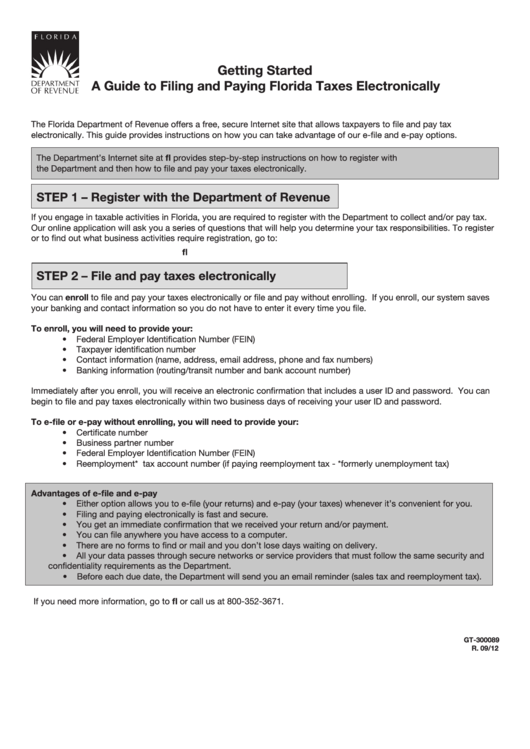

Getting Started

A Guide to Filing and Paying Florida Taxes Electronically

The Florida Department of Revenue offers a free, secure Internet site that allows taxpayers to file and pay tax

electronically. This guide provides instructions on how you can take advantage of our e-file and e-pay options.

The Department’s Internet site at provides step-by-step instructions on how to register with

the Department and then how to file and pay your taxes electronically.

STEP 1 – Register with the Department of Revenue

If you engage in taxable activities in Florida, you are required to register with the Department to collect and/or pay tax.

Our online application will ask you a series of questions that will help you determine your tax responsibilities. To register

or to find out what business activities require registration, go to:

/taxes/registration.html

STEP 2 – File and pay taxes electronically

You can enroll to file and pay your taxes electronically or file and pay without enrolling. If you enroll, our system saves

your banking and contact information so you do not have to enter it every time you file.

To enroll, you will need to provide your:

• Federal Employer Identification Number (FEIN)

• Taxpayer identification number

• Contact information (name, address, email address, phone and fax numbers)

• Banking information (routing/transit number and bank account number)

Immediately after you enroll, you will receive an electronic confirmation that includes a user ID and password. You can

begin to file and pay taxes electronically within two business days of receiving your user ID and password.

To e-file or e-pay without enrolling, you will need to provide your:

• Certificate number

• Business partner number

• Federal Employer Identification Number (FEIN)

• Reemployment* tax account number (if paying reemployment tax - *formerly unemployment tax)

Advantages of e-file and e-pay

• Either option allows you to e-file (your returns) and e-pay (your taxes) whenever it’s convenient for you.

• Filing and paying electronically is fast and secure.

• You get an immediate confirmation that we received your return and/or payment.

• You can file anywhere you have access to a computer.

• There are no forms to find or mail and you don’t lose days waiting on delivery.

• All your data passes through secure networks or service providers that must follow the same security and

confidentiality requirements as the Department.

• Before each due date, the Department will send you an email reminder (sales tax and reemployment tax).

If you need more information, go to /eservices or call us at 800-352-3671.

GT-300089

R. 09/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1