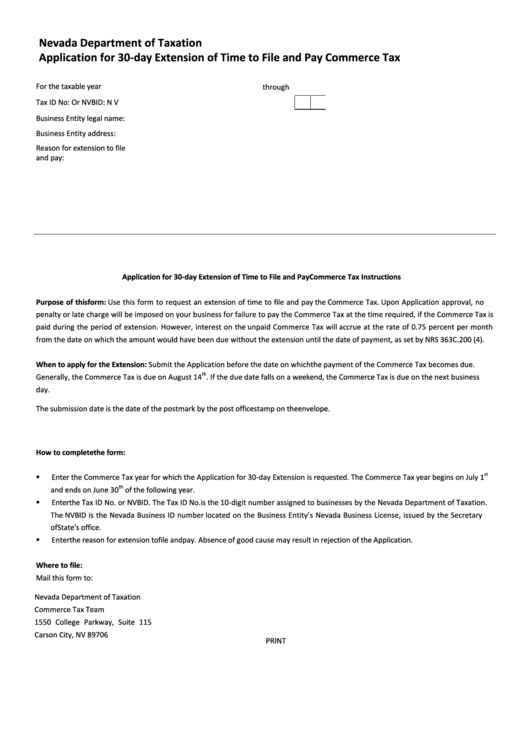

Nevada Department of Taxation

Application for 30-day Extension of Time to File and Pay Commerce Tax

For the taxable year

through

Tax ID No:

Or NVBID:

N

V

Business Entity legal name:

Business Entity address:

Reason for extension to file

and pay:

Application for 30-day Extension of Time to File and Pay Commerce Tax Instructions

Purpose of this form: Use this form to request an extension of time to file and pay the Commerce Tax. Upon Application approval, no

penalty or late charge will be imposed on your business for failure to pay the Commerce Tax at the time required, if the Commerce Tax is

paid during the period of extension. However, interest on the unpaid Commerce Tax will accrue at the rate of 0.75 percent per month

from the date on which the amount would have been due without the extension until the date of payment, as set by NRS 363C.200 (4).

When to apply for the Extension: Submit the Application before the date on which the payment of the Commerce Tax becomes due.

th

Generally, the Commerce Tax is due on August 14

. If the due date falls on a weekend, the Commerce Tax is due on the next business

day.

The submission date is the date of the postmark by the post office stamp on the envelope.

How to complete the form:

st

Enter the Commerce Tax year for which the Application for 30-day Extension is requested. The Commerce Tax year begins on July 1

th

and ends on June 30

of the following year.

Enter the Tax ID No. or NVBID. The Tax ID No. is the 10-digit number assigned to businesses by the Nevada Department of Taxation.

The NVBID is the Nevada Business ID number located on the Business Entity’s Nevada Business License, issued by the Secretary

of State's office.

Enter the reason for extension to file and pay. Absence of good cause may result in rejection of the Application.

Where to file:

Mail this form to:

Nevada Department of Taxation

Commerce Tax Team

1550 College Parkway, Suite 115

Carson City, NV 89706

PRINT

1

1