Form Tlt-1 - Transient Lodging Tax - City Of Waynesboro

ADVERTISEMENT

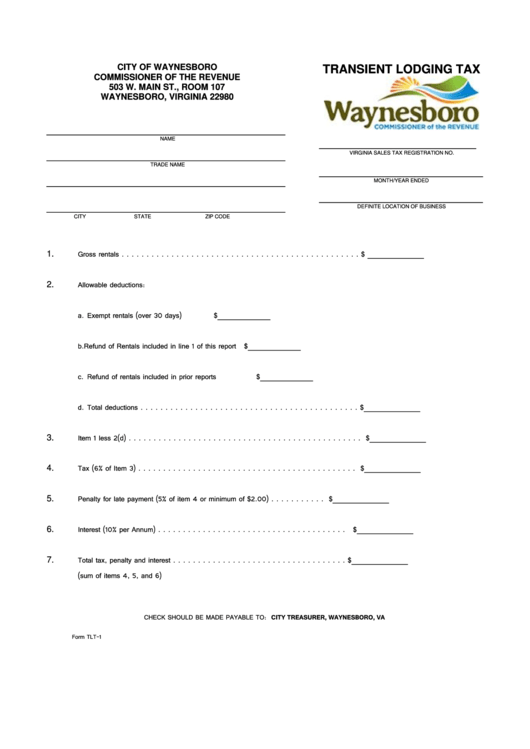

CITY OF WAYNESBORO

TRANSIENT LODGING TAX

COMMISSIONER OF THE REVENUE

503 W. MAIN ST., ROOM 107

WAYNESBORO, VIRGINIA 22980

___________________________________

NAME

_______________________

___________________________________

VIRGINIA SALES TAX REGISTRATION NO.

TRADE NAME

________________________

___________________________________

MONTH/YEAR ENDED

P.O. BOX OR MAILING ADDRESS

________________________

___________________________________

DEFINITE LOCATION OF BUSINESS

CITY

STATE

ZIP CODE

Gross rentals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ________________

1.

Allowable deductions:

2.

a. Exempt rentals (over 30 days)

$_______________

b. Refund of Rentals included in line 1 of this report $_______________

c. Refund of rentals included in prior reports

$_______________

d. Total deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $________________

Item 1 less 2(d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $________________

3.

Tax (6% of Item 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $________________

4.

Penalty for late payment (5% of item 4 or minimum of $2.00) . . . . . . . . . . .

$________________

5.

Interest (10% per Annum) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$________________

6.

Total tax, penalty and interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$________________

7.

(sum of items 4, 5, and 6)

CHECK SHOULD BE MADE PAYABLE TO: CITY TREASURER, WAYNESBORO, VA

Form TLT-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2