Print

Clear

Page 1

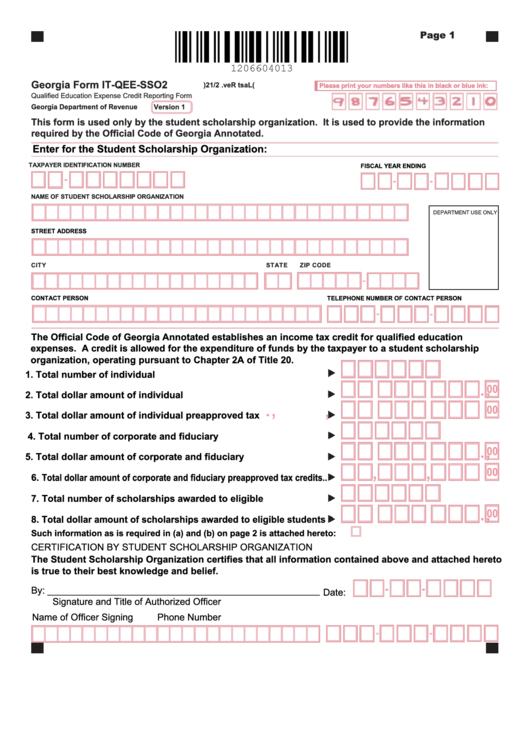

Georgia Form IT-QEE-SSO2

L (

a

t s

R

e

. v

2

1 /

) 2

Please print your numbers like this in black or blue ink:

Please print your numbers like this in black or blue ink:

Qualified Education Expense Credit Reporting Form

Georgia Department of Revenue

Version 1

This form is used only by the student scholarship organization. It is used to provide the information

required by the Official Code of Georgia Annotated.

Enter for the Student Scholarship Organization:

TAXPAYER IDENTIFICATION NUMBER

FISCAL YEAR ENDING

NAME OF STUDENT SCHOLARSHIP ORGANIZATION

DEPARTMENT USE ONLY

STREET ADDRESS

CITY

STATE

ZIP CODE

CONTACT PERSON

TELEPHONE NUMBER OF CONTACT PERSON

The Official Code of Georgia Annotated establishes an income tax credit for qualified education

expenses. A credit is allowed for the expenditure of funds by the taxpayer to a student scholarship

organization, operating pursuant to Chapter 2A of Title 20.

1. Total number of individual contributions........................................

,

,

.

00

2. Total dollar amount of individual contributions.............................

,

.

,

00

3. Total dollar amount of individual preapproved tax credits............

4. Total number of corporate and fiduciary contributions.................

,

,

.

00

5. Total dollar amount of corporate and fiduciary contributions......

,

.

,

00

6.

Total dollar amount of corporate and fiduciary preapproved tax credits..

7.

Total number of scholarships awarded to eligible students.........

,

,

.

00

8. Total dollar amount of scholarships awarded to eligible students

Such information as is required in (a) and (b) on page 2 is attached hereto:

CERTIFICATION BY STUDENT SCHOLARSHIP ORGANIZATION

The Student Scholarship Organization certifies that all information contained above and attached hereto

is true to their best knowledge and belief.

By: ____________________________________________________

Date:

Signature and Title of Authorized Officer

Name of Officer Signing

Phone Number

1

1