Print

Clear

Page 1

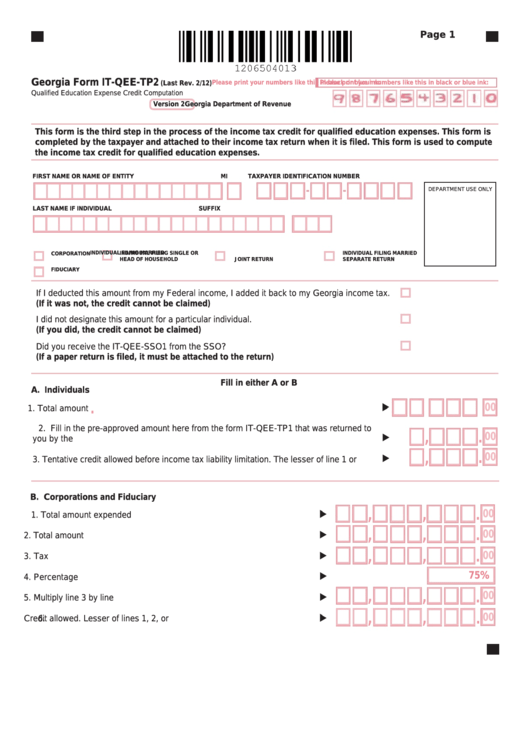

Georgia Form IT-QEE-TP2

Please print your numbers like this in black or blue ink:

Please print your numbers like this in black or blue ink:

(Last Rev. 2/12)

Qualified Education Expense Credit Computation

Georgia Department of Revenue

Version 2

This form is the third step in the process of the income tax credit for qualified education expenses. This form is

completed by the taxpayer and attached to their income tax return when it is filed. This form is used to compute

the income tax credit for qualified education expenses.

FIRST NAME OR NAME OF ENTITY

MI

TAXPAYER IDENTIFICATION NUMBER

DEPARTMENT USE ONLY

LAST NAME IF INDIVIDUAL

SUFFIX

INDIVIDUAL FILING SINGLE OR

INDIVIDUAL FILING MARRIED

INDIVIDUAL FILING MARRIED

CORPORATION

HEAD OF HOUSEHOLD

JOINT RETURN

SEPARATE RETURN

FIDUCIARY

If I deducted this amount from my Federal income, I added it back to my Georgia income tax.

(If it was not, the credit cannot be claimed)

I did not designate this amount for a particular individual.

(If you did, the credit cannot be claimed)

Did you receive the IT-QEE-SSO1 from the SSO?

(If a paper return is filed, it must be attached to the return)

Fill in either A or B

A. Individuals

.

00

1. Total amount expended.................................................................................................

2. Fill in the pre-approved amount here from the form IT-QEE-TP1 that was returned to

.

,

00

you by the Department.................................................................................................

,

.

00

3. Tentative credit allowed before income tax liability limitation. The lesser of line 1 or 2........

B. Corporations and Fiduciary

,

,

.

00

1. Total amount expended ........................................................................

.

,

,

00

2. Total amount approved..........................................................................

,

,

.

00

3. Tax liability...........................................................................................

75%

4. Percentage Limitation...........................................................................

,

,

.

00

5. Multiply line 3 by line 4.........................................................................

,

,

.

00

Credit allowed. Lesser of lines 1, 2, or 5................................................

6.

1

1 2

2