IT-4

Notice to Employee

1.

For state purposes, an individual may claim only natural depen-

If possible, file a new certificate by December 1st of the year in

dency exemptions. This includes the taxpayer, spouse, and each

which the death occurs.

dependent. Dependents are the same as defined in the Internal

Revenue Code and as claimed in the taxpayer’s federal income tax

For further information, consult the Ohio Department of Taxation,

return for the taxable year, or which the taxpayer would have been

Income tax Division, or your employer.

permitted to claim had the taxpayer filed such a return.

3.

If you expect to owe more Ohio income tax than will be withheld,

2.

You may file a new certificate at anytime if the number of your

you may claim a smaller number of exemptions; or under an agree-

exempts increases .

ment with your employer, you may have an additional amount with-

held each pay period.

You must file a new certificate within 10 days if the number of ex-

emptions previously claimed by you decreases because:

4.

A married couple with both spouses working and filing a joint re-

(a) Your spouse for whom you have been claiming exemption is

turn will, in many cases, be required to file a Declaration of Esti-

divorced or legally separated, or claim her (or his) own ex-

mated Individual Income Tax even though Ohio income tax is be-

emption on a separate certificate.

ing withheld from their wages. This is because the tax on their

(b) The support of a dependent for whom you claimed exemption

combined income will be greater than the sum of the taxes with-

is taken over by someone else.

held from the husband’s wages and the wife’s wages. This re-

(c)

You find that a dependent for whom you claimed exemption

quirement to file a Declaration of Estimated Individual Income Tax

must be dropped for Federal purposes.

may also apply to an individual who has two jobs, both of which

are subject to withholding. In lieu of filing the Declaration of Esti-

The death of a spouse or a dependent does not affect your with-

mated Individual Income Tax, the individual may provide for addi-

holding until the next year but requires the filing of a new certificate.

tional withholding with his employer by using line 5.

!

please detach here

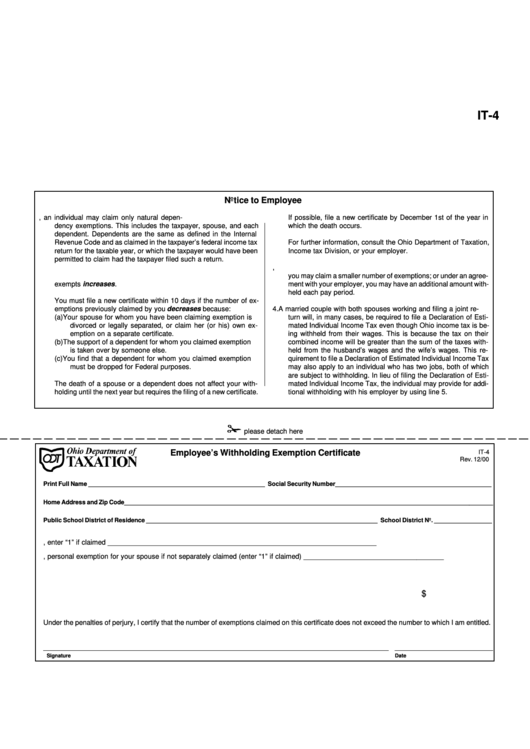

Employee’s Withholding Exemption Certificate

IT-4

Rev. 12/00

Print Full Name ____________________________________________________ Social Security Number______________________________________________

Home Address and Zip Code_____________________________________________________________________________________________________________

Public School District of Residence ____________________________________________________________________ School District No. _________________

1.

Personal exemption for yourself, enter “1” if claimed _____________________________________________________________________

2.

If married, personal exemption for your spouse if not separately claimed (enter “1” if claimed) ____________________________________

3.

Exemptions for dependents ________________________________________________________________________________________

4.

Add the exemptions which you have claimed above and enter total _________________________________________________________

$

5.

Additional withholding per pay period under agreement with employer _______________________________________________________

Under the penalties of perjury, I certify that the number of exemptions claimed on this certificate does not exceed the number to which I am entitled.

______________________________________________________________________________________________________ _____________________________

Signature

Date

1

1 2

2 3

3