Montana Form Mt-R Draft - Reciprocity Exemption From Withholding For North Dakota Residents Who Work In Montana - 2016 Page 2

ADVERTISEMENT

Form MT-R Instructions

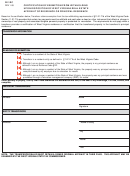

Purpose of this Form

Montana and North Dakota have a reciprocal agreement that Montana will not tax North Dakota residents

on compensation for personal or professional services performed in Montana, and North Dakota will not tax

Montana residents on compensation for services performed in North Dakota. Please note that the wages you

earn for work in Montana are subject to income tax in North Dakota.

Further, Montana employers of North Dakota residents are not required to withhold Montana income tax from

those employees’ compensation. Similarly, North Dakota employers of Montana residents are not required to

withhold North Dakota income tax from those employees’ compensation.

Instructions for Employee

Instructions for Employer

Fill out the form completely. Otherwise, your employer

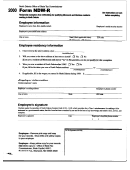

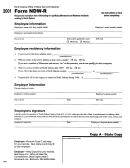

Employees who reside in North Dakota must

is required to withhold Montana income tax from your

complete this form and give it to you by February 28

wages.

of the calendar year to which it applies or within 30

days after they begin working for you or change their

Your employer will be able to provide you with its

residence. Employees who live in states other than

federal identification number.

North Dakota, including Montana, cannot use this

Make a copy of this form for your records and give the

form.

original to your employer.

For forms received by February 28, mail the original

If you do not want Montana income tax withheld

on or before March 31 to:

from your wages, you must complete this form

Montana Department of Revenue

and give it to your employer by February 28 of the

PO Box 5805

calendar year to which you want it to apply, within 30

Helena, MT 59604-5805

days of when you begin working or within 30 days of

when you become a North Dakota resident. You must

For new employees or employees who change their

complete a new form and give it to your employer

state of residence during the year, send the form

each year to continue receiving an exemption from

within 30 days after the employee gives it to you.

withholding.

An employee must complete this form and give it to

If you do not complete this form and give it to your

you each year to continue receiving an exemption

employer as explained above, your employer must

from withholding.

withhold Montana income tax from your wages.

You may be required to resume Montana withholding

If Montana income tax was already withheld from

on the employee’s compensation earned in Montana

your wages, you must complete and file a Montana

if the department determines that an employee’s

Individual Income Tax Return, Form 2, at the end of

certificate is false or unsubstantiated.

the year to obtain a refund. Please refer to Form 2

Administrative Rules of Montana: 42.17.134

and its instructions for more information about how to

Questions? Please call us toll free at (866) 859-2254

obtain this refund.

(in Helena, 444-6900)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2