Form D1 - Declaration Of Estimated Tax - 2000

ADVERTISEMENT

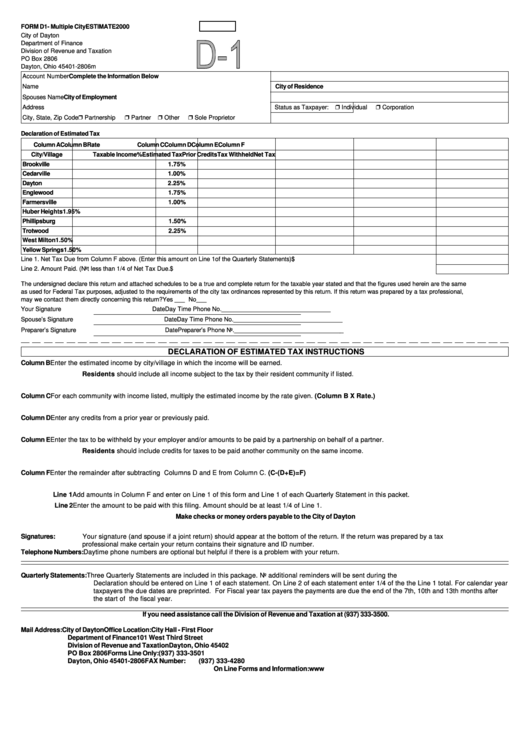

FORM D1- Multiple City

ESTIMATE

2000

City of Dayton

Department of Finance

Division of Revenue and Taxation

PO Box 2806

Dayton, Ohio 45401-2806

m

Account Number

Complete the Information Below

Name

City of Residence

Spouses Name

City of Employment

Address

Status as Taxpayer:

Individual

Corporation

City, State, Zip Code

Partnership

Partner

Other

Sole Proprietor

Declaration of Estimated Tax

Column A

Column B

Rate

Column C

Column D

Column E

Column F

City/Village

Taxable Income

%

Estimated Tax

Prior Credits

Tax Withheld

Net Tax

Brookville

1.75%

Cedarville

1.00%

Dayton

2.25%

Englewood

1.75%

Farmersville

1.00%

Huber Heights

1.95%

Phillipsburg

1.50%

Trotwood

2.25%

West Milton

1.50%

Yellow Springs

1.50%

Line 1. Net Tax Due from Column F above. (Enter this amount on Line 1of the Quarterly Statements)

$

Line 2. Amount Paid. (Not less than 1/4 of Net Tax Due.

$

The undersigned declare this return and attached schedules to be a true and complete return for the taxable year stated and that the figures used herein are the same

as used for Federal Tax purposes, adjusted to the requirements of the city tax ordinances represented by this return. If this return was prepared by a tax professional,

may we contact them directly concerning this return?

Yes ___ No___

Your Signature

Date

Day Time Phone No. ________________________________

Spouse’s Signature

Date

Day Time Phone No. ________________________________

Preparer’s Signature

Date

Preparer’s Phone No. ________________________________

DECLARATION OF ESTIMATED TAX INSTRUCTIONS

Column B

Enter the estimated income by city/village in which the income will be earned.

Residents should include all income subject to the tax by their resident community if listed.

Column C

For each community with income listed, multiply the estimated income by the rate given. (Column B X Rate.)

Column D

Enter any credits from a prior year or previously paid.

Column E

Enter the tax to be withheld by your employer and/or amounts to be paid by a partnership on behalf of a partner.

Residents should include credits for taxes to be paid another community on the same income.

Column F

Enter the remainder after subtracting Columns D and E from Column C. (C-(D+E)=F)

Line 1

Add amounts in Column F and enter on Line 1 of this form and Line 1 of each Quarterly Statement in this packet.

Line 2

Enter the amount to be paid with this filing. Amount should be at least 1/4 of Line 1.

Make checks or money orders payable to the City of Dayton

Signatures:

Your signature (and spouse if a joint return) should appear at the bottom of the return. If the return was prepared by a tax

professional make certain your return contains their signature and ID number.

Telephone Numbers:

Daytime phone numbers are optional but helpful if there is a problem with your return.

Quarterly Statements:

Three Quarterly Statements are included in this package. No additional reminders will be sent during the year.The amount on Line 1 of the

Declaration should be entered on Line 1 of each statement. On Line 2 of each statement enter 1/4 of the the Line 1 total. For calendar year

taxpayers the due dates are preprinted. For Fiscal year tax payers the payments are due the end of the 7th, 10th and 13th months after

the start of the fiscal year.

If you need assistance call the Division of Revenue and Taxation at (937) 333-3500.

Mail Address: City of Dayton

Office Location:

City Hall - First Floor

Department of Finance

101 West Third Street

Division of Revenue and Taxation

Dayton, Ohio 45402

PO Box 2806

Forms Line Only:

(937) 333-3501

Dayton, Ohio 45401-2806

FAX Number:

(937) 333-4280

On Line Forms and Information:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1