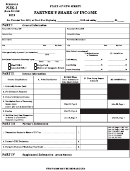

Schedule Vk-1 (Form 502) Draft - Owner'S Share Of Income And Virginia Modifications And Credits - 2006 Page 2

ADVERTISEMENT

2006

*VA0VK1206888*

Va. Schedule VK-1

Owner FEIN or SSN

Page 2

PTE FEIN

Virginia Subtractions - Owner’s Share

00

1 4. Fixed-date Conformity - Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

00

1 5. Fixed-date Conformity - Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

00

1 6. Income From Obligations Of The United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

00

1 7. a-e Refer To Instruction Book For Other

17a.

. . . . . . . . . . . 17a.

00

Subtraction Codes

17b.

. . . . . . . . . . . 17b.

00

17c.

. . . . . . . . . . . 17c.

00

17d.

. . . . . . . . . . . 17d.

00

17e.

. . . . . . . . . . . 17e.

00

1 8. Total Subtractions (Line 14 Through 17e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

w

Virginia Tax Credits And Related Information

Credits Allocable To Owners In Proportion To Owners’ Participation Percentages:

D R A F T

00

1 9. State Income Tax Paid (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19.

w

00

2 0. Neighborhood Assistance Act Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.

w

00

2 1a. Enterprise Zone Act General Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21a.

w

00

2 1b. Enterprise Zone Act Zone Investment Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21b.

w

11/10/06

00

2 1c. Enterprise Zone Taxable Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21c.

w

00

2 2. Conservation Tillage Equipment Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22.

w

00

2 3. Line Reserved For Future Use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23.

w

00

2 4. Fertilizer & Pesticide Application Equipment Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24.

w

00

2 5. Recyclable Materials Processing Equipment Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25.

w

00

2 6. Rent Reduction Program Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26.

w

00

2 7a. Vehicle Emissions - Clean-fuel Vehicle Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27a.

w

00

27b. Vehicle Emissions - Testing Equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27b.

w

00

w

28. Major Business Facility Job Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28.

00

w

2 9. Clean Fuel Vehicle Job Creation Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29.

00

w

3 0. Line Reserved For Future Use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30.

00

w

3 1. Day-care Facility Investment Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31.

00

w

3 2. Low-income Housing Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32.

00

w

3 3. Agricultural Best Management Practices Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33.

00

w

3 4. Worker Retraining Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34.

00

w

3 5. Waste Motor Oil Burning Equipment Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35.

00

w

3 6. Line Reserved For Future Use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36.

00

w

3 7. Riparian Forest Buffer Protection For Waterways . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37.

w

3 8. Virginia Coal And Production Incentive Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38.

00

w

38a. Enter the amount of credit assigned to another party . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38a.

00

w

38b. Amount available for use by owner (Subtract line 38a from line 38) . . . . . . . . . . . . . . . . . . . . . . . . . . . 38b.

00

C redits Allocable To Owners By Methods Other Than Participation Percentage

00

w

3 9. Historic Rehabilitation Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39.

00

w

4 0. Land Preservation Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40.

41. Qualified Equity & Subordinated Debt Investments Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41.

00

w

Refundable Credits

4 2.

100% Coalfield Employment Enhancement and/or Virginia Coal Employment and Production Incentive Tax

00

42.

Credits from Line 1 of your 2006 Schedule 306B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

42a 50% Coalfield Employment Enhancement Tax Credit from Line 2 of your 2006 Schedule 306B . . . . . . . . . . . . . 42a.

00

42b. Full credit: Enter amount from 2006 Form 306, Line 12a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42b.

00

42c Full credit: Enter amount from your 2006 Form 306, line 12b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42c.

00

42d 85% Credit: Enter amount from 2006 Form 306, line 13a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42d.

00

42e. 90% Credit: Enter amount from your 2006 Form 306, line 13b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42e.

42f. Total Coal Related Tax Credits allowable this year: Add Lines 42b,

00

w

42c, 42d and 42e . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42f.

42g. 2006 coalfield employment enhancement tax credit earned to be used when completing your 2009 return.

00

Enter amount from your 2006 Form 306, Line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42g.

w

43.

Enterprise Zone Real Property Improvement Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43.

00

00

w

4 4. Total Lines 19 Through 37, 38b, 39 Through 41, 42f and 43 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2