Form 70-017a - Iowa In-State Distributors Cigarette Tax Report Page 2

ADVERTISEMENT

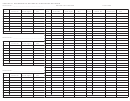

SECTION II. REVENUE SUMMARY

Iowa

Iowa

Totals

Totals

TOTAL STAMPS

(out of state)

(out of state)

FOR PACKS OF

Out of State Only

20’s

25’s

20’s

25’s

20’s

25’s

1. Beginning inventory

(prior month’s ending inventory unaffixed stamps)

1.

2. Add purchases this month (from Section I)

2.

3. Subtotal

3.

4. Less ending inventory (this month’s unaffixed stamps)

4.

5. Balance (revenue stamps used this month)

(A)

5.

SECTION II. REVENUE SUMMARY

Iowa

Iowa

Totals

Totals

TOTAL STAMPS

(out of state)

(out of state)

FOR PACKS OF

Out of State Only

20’s

25’s

20’s

25’s

20’s

25’s

1. Beginning inventory

(prior month’s ending inventory unaffixed stamps)

1.

2. Add purchases this month (from Section I)

2.

3. Subtotal

3.

4. Less ending inventory (this month’s unaffixed stamps)

4.

5. Balance (revenue stamps used this month)

(A)

5.

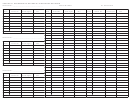

SECTION II. REVENUE SUMMARY

Iowa

Iowa

Totals

Totals

TOTAL STAMPS

(out of state)

(out of state)

FOR PACKS OF

Out of State Only

20’s

25’s

20’s

25’s

20’s

25’s

1. Beginning inventory

(prior month’s ending inventory unaffixed stamps)

1.

2. Add purchases this month (from Section I)

2.

3. Subtotal

3.

4. Less ending inventory (this month’s unaffixed stamps)

4.

5. Balance (revenue stamps used this month)

(A)

5.

All of the above states should be combined and entered in Section II

on the front side of this form under the columns “Totals (out of state)” for 20’s and 25’s.

FILING INSTRUCTIONS

Report Requirements:

The report must cover the period from the first day of the month to the last day of the month to be considered

complete. If merchandise has been returned to the factory unstamped, a credit will be allowed only if a credit

memorandum is attached.

Affixing Stamps:

Stamps must be affixed within 48 hours, exclusive of Sundays and legal holidays (IA Admin. Code 453A.10).

Due Date:

This report is due on or before the 10th day of the month following the month for which the report is made.

Penalty:

Civil penalty starts at $200.00 for late filed, incomplete, or false reports.

Penalty for failure to timely pay the tax due or penalty for audit deficiency: A penalty of 5% will be added to the

tax due if at least 90% of the correct amount of tax is not paid by the due date. The penalty can only be waived

under limited circumstances.

Where the failure to file penalty and one of the other penalties are applicable, the failure to file penalty will take

precedence.

70-017b (06/11/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4