Instructions For Form Rev-853r - Pa Corporation Taxes Annual Extension Reportreplacement Coupon

ADVERTISEMENT

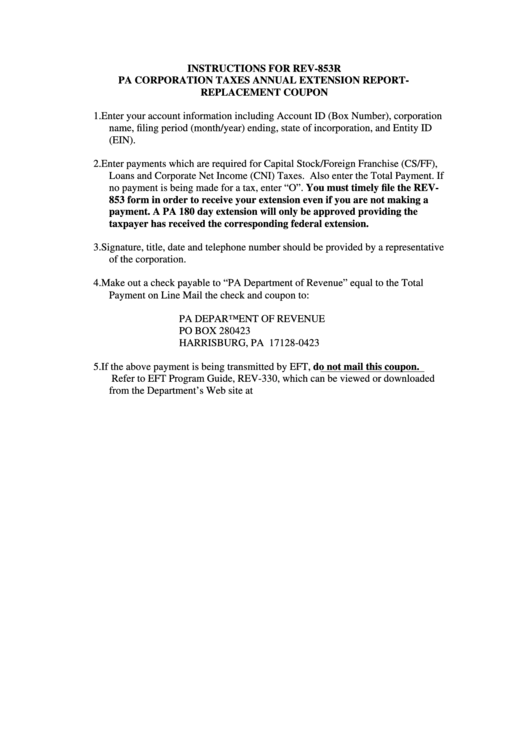

INSTRUCTIONS FOR REV-853R

PA CORPORATION TAXES ANNUAL EXTENSION REPORT-

REPLACEMENT COUPON

1. Enter your account information including Account ID (Box Number), corporation

name, filing period (month/year) ending, state of incorporation, and Entity ID

(EIN).

2. Enter payments which are required for Capital Stock/Foreign Franchise (CS/FF),

Loans and Corporate Net Income (CNI) Taxes. Also enter the Total Payment. If

no payment is being made for a tax, enter “O”. You must timely file the REV-

853 form in order to receive your extension even if you are not making a

payment. A PA 180 day extension will only be approved providing the

taxpayer has received the corresponding federal extension.

3. Signature, title, date and telephone number should be provided by a representative

of the corporation.

4. Make out a check payable to “PA Department of Revenue” equal to the Total

Payment on Line Mail the check and coupon to:

PA DEPARTMENT OF REVENUE

PO BOX 280423

HARRISBURG, PA 17128-0423

5. If the above payment is being transmitted by EFT, do not mail this coupon.

Refer to EFT Program Guide, REV-330, which can be viewed or downloaded

from the Department’s Web site at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3