Instructions For Form Rev-854 - Pa Corporation Taxes Ein/tax Year/address Change Coupon

ADVERTISEMENT

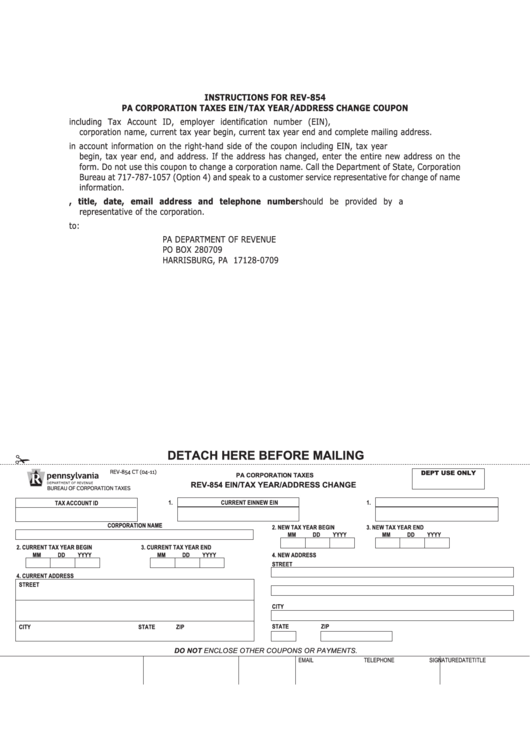

INSTRUCTIONS FOR REV-854

PA CORPORATION TAXES EIN/TAX YEAR/ADDRESS CHANGE COUPON

1. Enter account information including Tax Account ID, employer identification number (EIN),

corporation name, current tax year begin, current tax year end and complete mailing address.

2. Enter changes in account information on the right-hand side of the coupon including EIN, tax year

begin, tax year end, and address. If the address has changed, enter the entire new address on the

form. Do not use this coupon to change a corporation name. Call the Department of State, Corporation

Bureau at 717-787-1057 (Option 4) and speak to a customer service representative for change of name

information.

3. Signature, title, date, email address and telephone number should be provided by a

representative of the corporation.

4. Mail coupon to:

PA DEPARTMENT OF REVENUE

PO BOX 280709

HARRISBURG, PA 17128-0709

DETACH HERE BEFORE MAILING

✁

REV-854 CT (04-11)

DEPT USE ONLY

PA CORPORATION TAXES

REV-854 EIN/TAX YEAR/ADDRESS CHANGE

BUREAU OF CORPORATION TAXES

1.

1.

CURRENT EIN

NEW EIN

TAX ACCOUNT ID

CORPORATION NAME

2. NEW TAX YEAR BEGIN

3. NEW TAX YEAR END

MM

DD

YYYY

MM

DD

YYYY

2. CURRENT TAX YEAR BEGIN

3. CURRENT TAX YEAR END

MM

DD

YYYY

MM

DD

YYYY

4. NEW ADDRESS

STREET

4. CURRENT ADDRESS

STREET

CITY

STATE

ZIP

CITY

STATE

ZIP

DO NOT ENCLOSE OTHER COUPONS OR PAYMENTS.

SIGNATURE

TITLE

DATE

EMAIL

TELEPHONE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1