Application For A City Sales Tax Permit - City Of Ketchum

ADVERTISEMENT

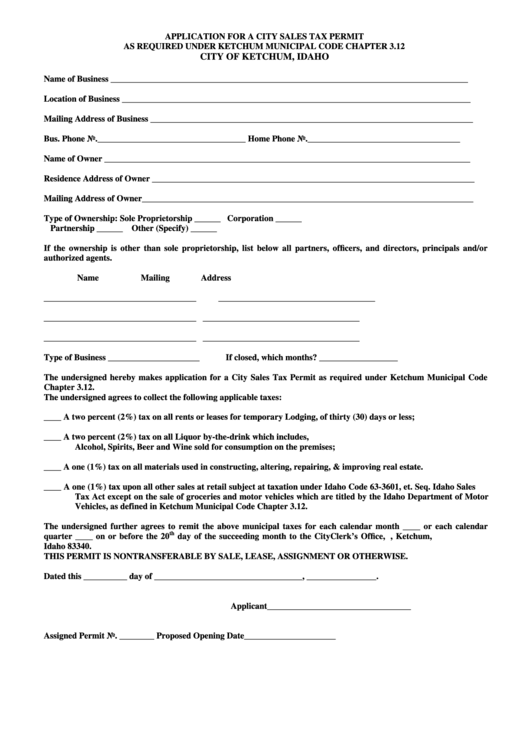

APPLICATION FOR A CITY SALES TAX PERMIT

AS REQUIRED UNDER KETCHUM MUNICIPAL CODE CHAPTER 3.12

CITY OF KETCHUM, IDAHO

Name of Business __________________________________________________________________________________

Location of Business ________________________________________________________________________________

Mailing Address of Business __________________________________________________________________________

Bus. Phone No.__________________________________

Home Phone No.___________________________________

Name of Owner ____________________________________________________________________________________

Residence Address of Owner __________________________________________________________________________

Mailing Address of Owner____________________________________________________________________________

Type of Ownership:

Sole Proprietorship ______ Corporation ______

Partnership ______ Other (Specify) ______

If the ownership is other than sole proprietorship, list below all partners, officers, and directors, principals and/or

authorized agents.

Name

Mailing Address

___________________________________

____________________________________

___________________________________

____________________________________

___________________________________

____________________________________

Type of Business _____________________

If closed, which months? __________________

The undersigned hereby makes application for a City Sales Tax Permit as required under Ketchum Municipal Code

Chapter 3.12.

The undersigned agrees to collect the following applicable taxes:

____

A two percent (2%) tax on all rents or leases for temporary Lodging, of thirty (30) days or less;

____

A two percent (2%) tax on all Liquor by-the-drink which includes,

Alcohol, Spirits, Beer and Wine sold for consumption on the premises;

____

A one (1%) tax on all materials used in constructing, altering, repairing, & improving real estate.

____

A one (1%) tax upon all other sales at retail subject at taxation under Idaho Code 63-3601, et. Seq. Idaho Sales

Tax Act except on the sale of groceries and motor vehicles which are titled by the Idaho Department of Motor

Vehicles, as defined in Ketchum Municipal Code Chapter 3.12.

The undersigned further agrees to remit the above municipal taxes for each calendar month ____ or each calendar

th

quarter ____ on or before the 20

day of the succeeding month to the City Clerk’s Office, P.O. Box 2315, Ketchum,

Idaho 83340.

THIS PERMIT IS NONTRANSFERABLE BY SALE, LEASE, ASSIGNMENT OR OTHERWISE.

Dated this __________ day of __________________________________, ________________.

Applicant_________________________________

Assigned Permit No. ________

Proposed Opening Date_____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1