Instructions For Report Preparation And Exemption Worksheet - Georgia Department Of Revenue

ADVERTISEMENT

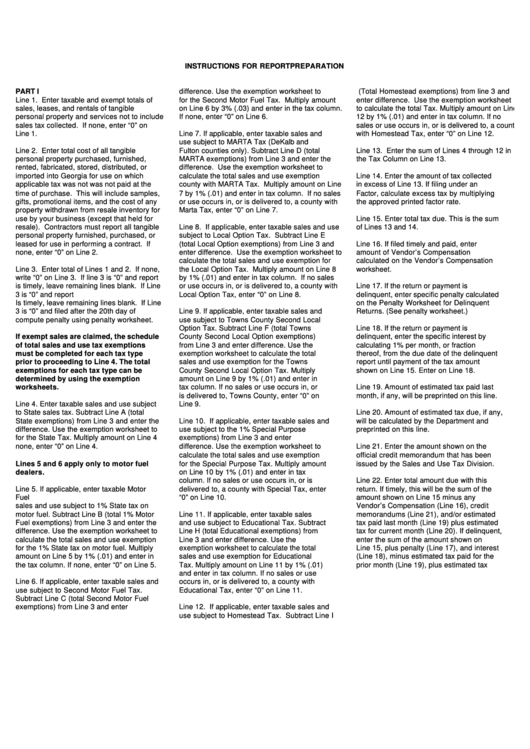

INSTRUCTIONS FOR REPORT PREPARATION

PART I

difference. Use the exemption worksheet to

(Total Homestead exemptions) from line 3 and

Line 1. Enter taxable and exempt totals of

for the Second Motor Fuel Tax. Multiply amount

enter difference. Use the exemption worksheet

sales, leases, and rentals of tangible

on Line 6 by 3% (.03) and enter in the tax column.

to calculate the total Tax. Multiply amount on Line

personal property and services not to include

If none, enter “0” on Line 6.

12 by 1% (.01) and enter in tax column. If no

sales tax collected. If none, enter “0” on

sales or use occurs in, or is delivered to, a county

Line 1.

Line 7. If applicable, enter taxable sales and

with Homestead Tax, enter “0” on Line 12.

use subject to MARTA Tax (DeKalb and

Line 2. Enter total cost of all tangible

Fulton counties only). Subtract Line D (total

Line 13. Enter the sum of Lines 4 through 12 in

personal property purchased, furnished,

MARTA exemptions) from Line 3 and enter the

the Tax Column on Line 13.

rented, fabricated, stored, distributed, or

difference. Use the exemption worksheet to

imported into Georgia for use on which

calculate the total sales and use exemption

Line 14. Enter the amount of tax collected

applicable tax was not was not paid at the

county with MARTA Tax. Multiply amount on Line

in excess of Line 13. If filing under an

time of purchase. This will include samples,

7 by 1% (.01) and enter in tax column. If no sales

Factor, calculate excess tax by multiplying

gifts, promotional items, and the cost of any

or use occurs in, or is delivered to, a county with

the approved printed factor rate.

property withdrawn from resale inventory for

Marta Tax, enter “0” on Line 7.

use by your business (except that held for

Line 15. Enter total tax due. This is the sum

resale). Contractors must report all tangible

Line 8. If applicable, enter taxable sales and use

of Lines 13 and 14.

personal property furnished, purchased, or

subject to Local Option Tax. Subtract Line E

leased for use in performing a contract. If

(total Local Option exemptions) from Line 3 and

Line 16. If filed timely and paid, enter

none, enter “0” on Line 2.

enter difference. Use the exemption worksheet to

amount of Vendor’s Compensation

calculate the total sales and use exemption for

calculated on the Vendor’s Compensation

Line 3. Enter total of Lines 1 and 2. If none,

the Local Option Tax. Multiply amount on Line 8

worksheet.

write “0” on Line 3. If line 3 is “0” and report

by 1% (.01) and enter in tax column. If no sales

is timely, leave remaining lines blank. If Line

or use occurs in, or is delivered to, a county with

Line 17. If the return or payment is

3 is “0” and report

Local Option Tax, enter “0” on Line 8.

delinquent, enter specific penalty calculated

Is timely, leave remaining lines blank. If Line

on the Penalty Worksheet for Delinquent

3 is “0” and filed after the 20th day of

Line 9. If applicable, enter taxable sales and

Returns. (See penalty worksheet.)

compute penalty using penalty worksheet.

use subject to Towns County Second Local

Option Tax. Subtract Line F (total Towns

Line 18. If the return or payment is

If exempt sales are claimed, the schedule

County Second Local Option exemptions)

delinquent, enter the specific interest by

of total sales and use tax exemptions

from Line 3 and enter difference. Use the

calculating 1% per month, or fraction

must be completed for each tax type

exemption worksheet to calculate the total

thereof, from the due date of the delinquent

prior to proceeding to Line 4. The total

sales and use exemption for the Towns

report until payment of the tax amount

exemptions for each tax type can be

County Second Local Option Tax. Multiply

shown on Line 15. Enter on Line 18.

determined by using the exemption

amount on Line 9 by 1% (.01) and enter in

worksheets.

tax column. If no sales or use occurs in, or

Line 19. Amount of estimated tax paid last

is delivered to, Towns County, enter “0” on

month, if any, will be preprinted on this line.

Line 4. Enter taxable sales and use subject

Line 9.

to State sales tax. Subtract Line A (total

Line 20. Amount of estimated tax due, if any,

State exemptions) from Line 3 and enter the

Line 10. If applicable, enter taxable sales and

will be calculated by the Department and

difference. Use the exemption worksheet to

use subject to the 1% Special Purpose

preprinted on this line.

for the State Tax. Multiply amount on Line 4

exemptions) from Line 3 and enter

none, enter “0” on Line 4.

difference. Use the exemption worksheet to

Line 21. Enter the amount shown on the

calculate the total sales and use exemption

official credit memorandum that has been

Lines 5 and 6 apply only to motor fuel

for the Special Purpose Tax. Multiply amount

issued by the Sales and Use Tax Division.

dealers.

on Line 10 by 1% (.01) and enter in tax

column. If no sales or use occurs in, or is

Line 22. Enter total amount due with this

Line 5. If applicable, enter taxable Motor

delivered to, a county with Special Tax, enter

return. If timely, this will be the sum of the

Fuel

“0” on Line 10.

amount shown on Line 15 minus any

sales and use subject to 1% State tax on

Vendor’s Compensation (Line 16), credit

motor fuel. Subtract Line B (total 1% Motor

Line 11. If applicable, enter taxable sales

memorandums (Line 21), and/or estimated

Fuel exemptions) from Line 3 and enter the

and use subject to Educational Tax. Subtract

tax paid last month (Line 19) plus estimated

difference. Use the exemption worksheet to

Line H (total Educational exemptions) from

tax for current month (Line 20). If delinquent,

calculate the total sales and use exemption

Line 3 and enter difference. Use the

enter the sum of the amount shown on

for the 1% State tax on motor fuel. Multiply

exemption worksheet to calculate the total

Line 15, plus penalty (Line 17), and interest

amount on Line 5 by 1% (.01) and enter in

sales and use exemption for Educational

(Line 18), minus estimated tax paid for the

the tax column. If none, enter “0” on Line 5.

Tax. Multiply amount on Line 11 by 1% (.01)

prior month (Line 19), plus estimated tax

and enter in tax column. If no sales or use

Line 6. If applicable, enter taxable sales and

occurs in, or is delivered to, a county with

use subject to Second Motor Fuel Tax.

Educational Tax, enter “0” on Line 11.

Subtract Line C (total Second Motor Fuel

exemptions) from Line 3 and enter

Line 12. If applicable, enter taxable sales and

use subject to Homestead Tax. Subtract Line I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3