Substantial Rehabilitation Worksheet - Georgia Department Of Revenue

ADVERTISEMENT

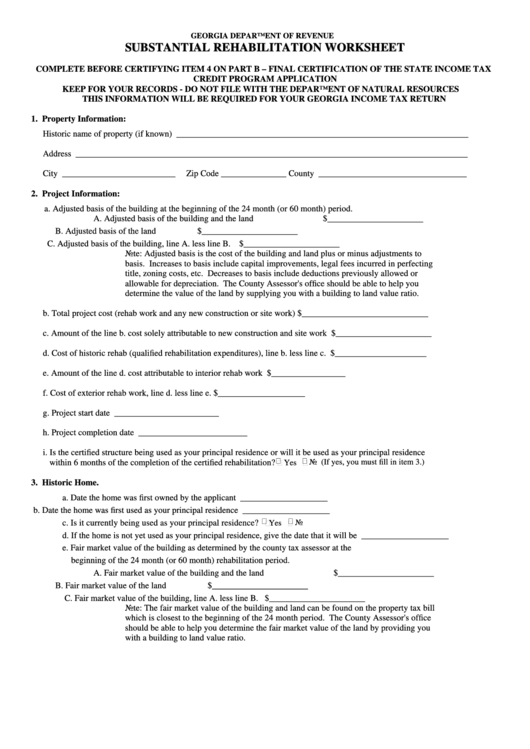

GEORGIA DEPARTMENT OF REVENUE

S

U

B

S

T

A

N

T

I

A

L

R

E

H

A

B

I

L

I

T

A

T

I

O

N

W

O

R

K

S

H

E

E

T

S

U

B

S

T

A

N

T

I

A

L

R

E

H

A

B

I

L

I

T

A

T

I

O

N

W

O

R

K

S

H

E

E

T

COMPLETE BEFORE CERTIFYING ITEM 4 ON PART B – FINAL CERTIFICATION OF THE STATE INCOME TAX

CREDIT PROGRAM APPLICATION

KEEP FOR YOUR RECORDS - DO NOT FILE WITH THE DEPARTMENT OF NATURAL RESOURCES

THIS INFORMATION WILL BE REQUIRED FOR YOUR GEORGIA INCOME TAX RETURN

1. Property Information:

Historic name of property (if known) ___________________________________________________________________

Address __________________________________________________________________________________________

City __________________________

Zip Code _______________ County __________________________________

2. Project Information:

a. Adjusted basis of the building at the beginning of the 24 month (or 60 month) period.

A. Adjusted basis of the building and the land

$______________________

B. Adjusted basis of the land

$______________________

C. Adjusted basis of the building, line A. less line B.

$______________________

Note: Adjusted basis is the cost of the building and land plus or minus adjustments to

basis. Increases to basis include capital improvements, legal fees incurred in perfecting

title, zoning costs, etc. Decreases to basis include deductions previously allowed or

allowable for depreciation. The County Assessor's office should be able to help you

determine the value of the land by supplying you with a building to land value ratio.

b. Total project cost (rehab work and any new construction or site work) $_____________________________

c. Amount of the line b. cost solely attributable to new construction and site work $______________________

d. Cost of historic rehab (qualified rehabilitation expenditures), line b. less line c. $_____________________

e. Amount of the line d. cost attributable to interior rehab work $_________________

f. Cost of exterior rehab work, line d. less line e. $____________________

g. Project start date ________________________

h. Project completion date _________________________

i. Is the certified structure being used as your principal residence or will it be used as your principal residence

within 6 months of the completion of the certified rehabilitation?

Yes

No (If yes, you must fill in item 3.)

3. Historic Home.

a. Date the home was first owned by the applicant ____________________

b. Date the home was first used as your principal residence ____________________

c. Is it currently being used as your principal residence?

Yes

No

d. If the home is not yet used as your principal residence, give the date that it will be ____________________

e. Fair market value of the building as determined by the county tax assessor at the

beginning of the 24 month (or 60 month) rehabilitation period.

A. Fair market value of the building and the land

$______________________

B. Fair market value of the land

$______________________

C. Fair market value of the building, line A. less line B.

$______________________

Note: The fair market value of the building and land can be found on the property tax bill

which is closest to the beginning of the 24 month period. The County Assessor's office

should be able to help you determine the fair market value of the land by providing you

with a building to land value ratio.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2