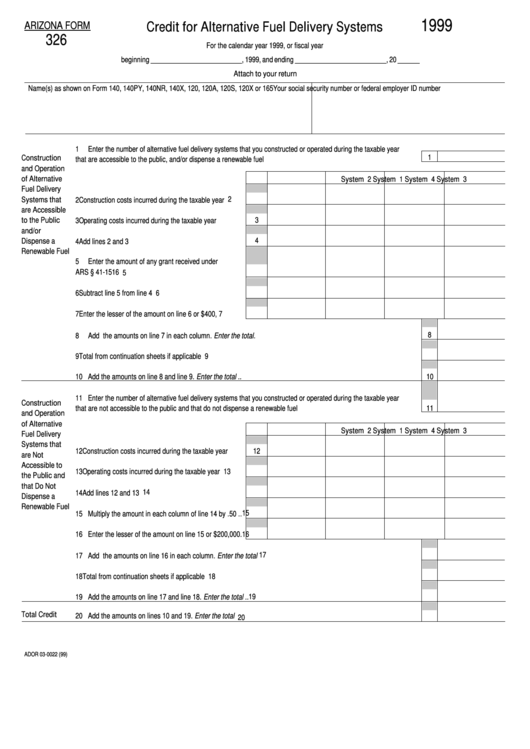

Form 326 - Credit For Alternative Fuel Delivery Systems - 1999

ADVERTISEMENT

1999

Credit for Alternative Fuel Delivery Systems

ARIZONA FORM

326

For the calendar year 1999, or fiscal year

beginning _________________________, 1999, and ending _________________________, 20 ______

Attach to your return

Name(s) as shown on Form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X or 165

Your social security number or federal employer ID number

1

Enter the number of alternative fuel delivery systems that you constructed or operated during the taxable year

1

Construction

that are accessible to the public, and/or dispense a renewable fuel ...............................................................................

and Operation

of Alternative

System 1

System 2

System 3

System 4

Fuel Delivery

2

Systems that

2

Construction costs incurred during the taxable year ....

are Accessible

3

to the Public

3

Operating costs incurred during the taxable year ........

and/or

4

Dispense a

4

Add lines 2 and 3 .........................................................

Renewable Fuel

5

Enter the amount of any grant received under

ARS § 41-1516 ............................................................

5

6

Subtract line 5 from line 4 ............................................

6

7

Enter the lesser of the amount on line 6 or $400,000...

7

8

8

Add the amounts on line 7 in each column. Enter the total. ...........................................................................................

9

Total from continuation sheets if applicable ....................................................................................................................

9

10

10 Add the amounts on line 8 and line 9. Enter the total .....................................................................................................

11 Enter the number of alternative fuel delivery systems that you constructed or operated during the taxable year

Construction

11

that are not accessible to the public and that do not dispense a renewable fuel ............................................................

and Operation

of Alternative

System 1

System 2

System 3

System 4

Fuel Delivery

Systems that

12 Construction costs incurred during the taxable year ....

12

are Not

Accessible to

13 Operating costs incurred during the taxable year ........

13

the Public and

that Do Not

14

14 Add lines 12 and 13 .....................................................

Dispense a

Renewable Fuel

15

15 Multiply the amount in each column of line 14 by .50 ..

16 Enter the lesser of the amount on line 15 or $200,000.

16

17

17 Add the amounts on line 16 in each column. Enter the total ..........................................................................................

18 Total from continuation sheets if applicable ....................................................................................................................

18

19

19 Add the amounts on line 17 and line 18. Enter the total .................................................................................................

Total Credit

20 Add the amounts on lines 10 and 19. Enter the total ......................................................................................................

20

ADOR 03-0022 (99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3