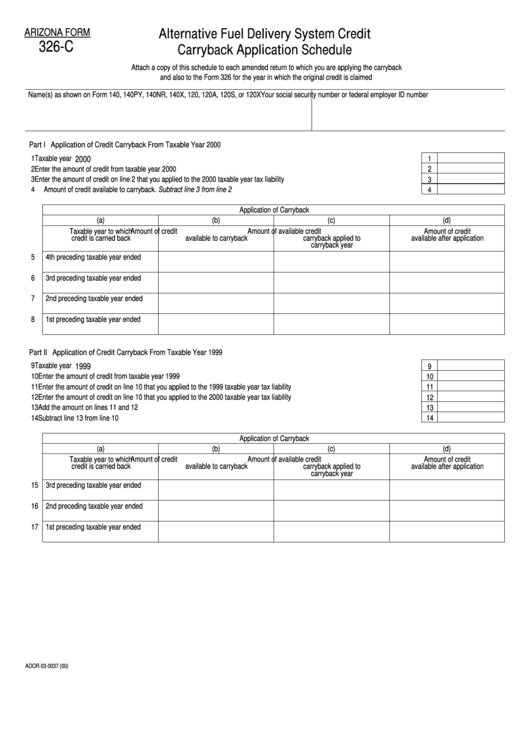

Form 326-C - Alternative Fuel Delivery System Credit - Carryback Application Schedule

ADVERTISEMENT

ARIZONA FORM

Alternative Fuel Delivery System Credit

326-C

Carryback Application Schedule

Attach a copy of this schedule to each amended return to which you are applying the carryback

and also to the Form 326 for the year in which the original credit is claimed

Name(s) as shown on Form 140, 140PY, 140NR, 140X, 120, 120A, 120S, or 120X

Your social security number or federal employer ID number

Part I Application of Credit Carryback From Taxable Year 2000

1

Taxable year .............................................................................................................................................................................................

2000

1

2

Enter the amount of credit from taxable year 2000 ..................................................................................................................................

2

3

Enter the amount of credit on line 2 that you applied to the 2000 taxable year tax liability ......................................................................

3

4

Amount of credit available to carryback. Subtract line 3 from line 2 ........................................................................................................

4

Application of Carryback

(a)

(b)

(c)

(d)

Taxable year to which

Amount of credit

Amount of available credit

Amount of credit

credit is carried back

available to carryback

carryback applied to

available after application

carryback year

5

4th preceding taxable year ended

6

3rd preceding taxable year ended

7

2nd preceding taxable year ended

8

1st preceding taxable year ended

Part II Application of Credit Carryback From Taxable Year 1999

9

Taxable year ............................................................................................................................................................................................

1999

9

10 Enter the amount of credit from taxable year 1999 ..................................................................................................................................

10

11 Enter the amount of credit on line 10 that you applied to the 1999 taxable year tax liability ...................................................................

11

12 Enter the amount of credit on line 10 that you applied to the 2000 taxable year tax liability ...................................................................

12

13 Add the amount on lines 11 and 12 .........................................................................................................................................................

13

14 Subtract line 13 from line 10 ....................................................................................................................................................................

14

Application of Carryback

(a)

(b)

(c)

(d)

Taxable year to which

Amount of credit

Amount of available credit

Amount of credit

credit is carried back

available to carryback

carryback applied to

available after application

carryback year

15 3rd preceding taxable year ended

16 2nd preceding taxable year ended

17 1st preceding taxable year ended

ADOR 03-0037 (00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1