Illinois Refund Transfer Written Disclosure Page 5

ADVERTISEMENT

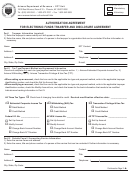

NEW YORK STATE REFUND TRANSFER

DISCLOSURE STATEMENT

YOU ARE NOT REQUIRED TO ENTER INTO THIS REFUND TRANSFER

AGREEMENT MERELY BECAUSE YOU HAVE RECEIVED THIS

INFORMATION.

IF YOU DO TAKE OUT THIS REFUND TRANSFER, YOU WILL BE

RESPONSIBLE TO PAY $_________ IN FEES FOR THE CHECK OR

DIRECT DEPOSIT TO BE ISSUED BY REPUBLIC BANK & TRUST

COMPANY. YOU CAN AVOID THIS FEE AND STILL RECEIVE YOUR

REFUND IN THE SAME AMOUNT OF TIME BY HAVING YOUR REFUND

DIRECTLY DEPOSITED INTO YOUR OWN BANK ACCOUNT. YOU CAN

ALSO WAIT FOR THE FEDERAL OR STATE REFUND TO BE MAILED TO

YOU.

IF YOU DO ENTER INTO THIS REFUND TRANSFER AGREEMENT,

YOU CAN EXPECT TO RECEIVE YOUR CHECK BY APPROXIMATELY

TWO BUSINESS DAYS OF (insert date)*.

IF YOU DO NOT ENTER INTO THIS REFUND TRANSFER AGREEMENT,

YOU CAN STILL RECEIVE YOUR TAX REFUND QUICKLY.

IF YOU FILE YOUR TAX RETURN ELECTRONICALLY AND RECEIVE

YOUR TAX REFUND THROUGH THE MAIL, YOU CAN EXPECT TO

RECEIVE YOUR REFUND WITHIN APPROXIMATELY TWO BUSINESS

D A Y S O F ( i n s e r t d a t e ) * . I F Y O U F I L E Y O U R T A X R E T U R N

ELECTRONICALLY AND HAVE YOUR TAX REFUND DIRECTLY

DEPOSITED INTO A BANK ACCOUNT, YOU CAN EXPECT TO RECEIVE

YOUR REFUND WITHIN APPROXIMATELY TWO DAYS OF (insert date)*.

* Based on information published on as of October 2012, the IRS

issues over 90% of refunds within 21 days. Visit for details about your

individual refund. Republic Bank & Trust Company does not guarantee whether,

when or in what amount a tax refund will be issued

.

Primary Taxpayer Signature: ______________________________

Additional Taxpayer Signature: _____________________________ (if joint return)

Tax Preparer Name: _____________________________________

New York Tax Preparer ID Number: ______________________

100640202

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5