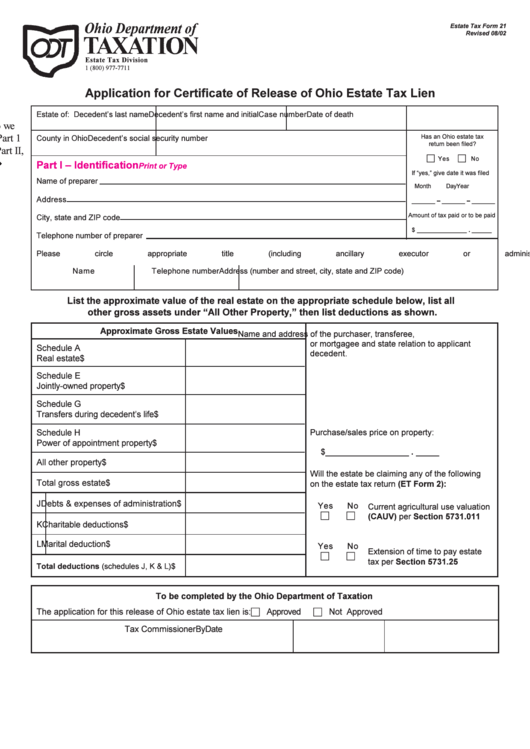

Estate Tax Form 21 - Application For Certificate Of Release Of Ohio Estate Tax Lien

ADVERTISEMENT

Estate Tax Form 21

Revised 08/02

Estate Tax Division

1 (800) 977-7711

Application for Certificate of Release of Ohio Estate Tax Lien

Estate of: Decedent’s last name

Decedent’s first name and initial

Case number

Date of death

o we

Part 1

Has an Ohio estate tax

County in Ohio

Decedent’s social security number

return been filed?

Part II,

c

c

Yes

No

è

Part I – Identification

Print or Type

If “yes,” give date it was filed

Name of preparer

Month

Day

Year

Address

_______ – _______ – _______

Amount of tax paid or to be paid

City, state and ZIP code

$ _______________ . ______

Telephone number of preparer

Please circle appropriate title (including ancillary executor or administrator):

Executor

Administrator(s)

Name

Telephone number

Address (number and street, city, state and ZIP code)

List the approximate value of the real estate on the appropriate schedule below, list all

other gross assets under “All Other Property,” then list deductions as shown.

Approximate Gross Estate Values

Name and address of the purchaser, transferee,

or mortgagee and state relation to applicant

Schedule A

decedent.

Real estate

$

Schedule E

Jointly-owned property

$

Schedule G

Transfers during decedent’s life

$

Schedule H

Purchase/sales price on property:

Power of appointment property

$

$__________________ . _____

All other property

$

Will the estate be claiming any of the following

Total gross estate

$

on the estate tax return (ET Form 2):

J Debts & expenses of administration

$

Yes

No

Current agricultural use valuation

c

c

(CAUV) per Section 5731.011

K Charitable deductions

$

O.R.C.

L Marital deduction

$

Yes

No

Extension of time to pay estate

c

c

tax per Section 5731.25 O.R.C.

Total deductions (schedules J, K & L)

$

To be completed by the Ohio Department of Taxation

The application for this release of Ohio estate tax lien is:

c Approved

c Not Approved

Tax Commissioner

By

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1