Uniform Domestic Relations Form 17 - Shared Parenting Plan Page 12

ADVERTISEMENT

Order, the following:

• Information regarding the benefits, limitations, and exclusions of the health insurance coverage

• Copies of any insurance form necessary to receive reimbursement, payment, or other benefits

under the coverage

• A copy of any necessary health insurance cards

The Health Plan Administrator that provides the private health insurance coverage for the child(ren)

may continue making payment for medical, optical, hospital, dental, or prescription services directly

to any health care provider in accordance with the applicable private health insurance policy,

contract, or plan.

The Obligor and/or Obligee required to provide private health insurance for the child(ren) must

designate said child(ren) as dependents under any private health insurance policy, contract, or plan

for which the person contracts.

The employer of the person required to provide private health insurance coverage is required to

release to the other parent, any person subject to an order issued under section 3109.19 of the

Revised Code, or the CSEA, upon written request, any necessary information regarding health

insurance coverage, including the name and address of the health plan administrator and any policy,

contract, or plan number, and the employer will otherwise comply with all orders and notices issued.

If the person required to obtain private health insurance coverage for the child(ren) subject to this

Support Order obtains new employment, the agency shall comply with the requirements of section

3119.34 of the Revised Code, which may result in the issuance of a notice requiring the new

employer to take whatever action is necessary to enroll the child(ren) in private health insurance

coverage provided by the new employer.

Upon receipt of notice by the CSEA that private health insurance coverage is not available at a

reasonable cost, cash medical support shall be paid in the amount as determined by the child

support computation worksheets in section 3119.022 or 3119.023 of the Revised Code, as

applicable. The CSEA may change the financial obligations of the parties to pay child support in

accordance with the terms of the court or administrative order and cash medical support without a

hearing or additional notice to the parties.

An Obligor that is in arrears in the Obligor’s child support obligation is subject to having any federal,

state and/or local income tax refund to which the Obligor may be entitled forwarded to the CSEA for

payment toward these arrears. Such refunds will continue to be forwarded to the CSEA for payment

until all arrears owed are paid in full. If the Obligor is married and files a joint tax return, the Obligor’s

spouse may contact the CSEA about filing an “Injured Spouse” claim after the Obligor is notified by

the Internal Revenue Service that the Obligor’s refund is being forwarded to the CSEA.

Pursuant to section 3121.29 of the Revised Code, the parties are notified as follows:

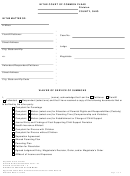

Supreme Court of Ohio

Uniform Domestic Relations Form – 17

SHARED PARENTING PLAN

Approved under Ohio Civil Rule 84 and Ohio Juvenile Rule 46

Amended: March 15, 2016

Page 12 of 14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14