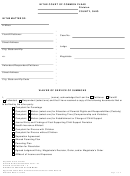

Uniform Domestic Relations Form 17 - Shared Parenting Plan Page 14

ADVERTISEMENT

B.

Other orders regarding tax exemptions (specify):

If a non-residential parent is entitled to claim the child(ren), the residential parent is required to execute

and deliver Internal Revenue Service Form 8332, or its successor, together with any other required forms

as set out in section 152 of the Internal Revenue Code, as amended, on or before February 15th

of the year following the tax year in question, to allow the non-residential parent to claim the

child(ren).

SIXTH: MODIFICATION

This Shared Parenting Plan may be modified by agreement of the parties or by the Court.

SEVENTH: OTHER

Upon approval by the Court, this Shared Parenting Plan shall be incorporated in the Judgment Entry.

Your Signature (Plaintiff/Petitioner 1)

Your Signature (Defendant/Petitioner 2)

Date

Date

Supreme Court of Ohio

Uniform Domestic Relations Form – 17

SHARED PARENTING PLAN

Approved under Ohio Civil Rule 84 and Ohio Juvenile Rule 46

Amended: March 15, 2016

Page 14 of 14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14